Shell may be selling its licenses in Ogoniland in Rivers State, Nigeria but the oil giant could struggle to offload the assets in a region where it has faced criticism for failure to adequately clean up decades of oil spills.

An industry report recently suggested that Shell is working to sell its 30% interest as well as those of partners Total (10%) and ENI (5%) in OML 11 in Ogoniland.

A Shell spokesman declined to comment on the sale of OML 11, but sources within the company confirmed it is carrying out “a strategic review of its operations in the eastern Niger Delta.”

Shell, Nigeria’s oldest and its largest operator, was forced to leave Ogoniland in 1993 following community unrest sparked by poverty and allegations of environmental neglect. For over 20 years, 23 producing fields in the OML 11 block have been lying idle as Shell and the Ogoni community battle out a long-running dispute over oil spillages that have polluted the area.

Local reports said that Shell wanted to kick-start the sale process before Nigeria’s presidential elections scheduled for next February but industry sources said the company could struggle to find a buyer.

“There are a series of legal issues in the area but Shell’s singular problem is the environmental damage in the region,” an industry source said Wednesday.

“Shell faces many challenges in the area — there is still a frosty relationship with the [Ogoni] community. But there are also issues such as the United Nations Environmental Program (UNEP) report and claims that the region will take 30 years to recover from oil spillages. Finding buyers who are willing to enter such a damaged area will not be easy,” a Lagos-based oil executive said.

Amnesty International in a report published in August said the Nigerian government and Shell have failed to act on the UN 2011 report on the clean-up of the widespread oil spills in the region.

A recommendation by UNEP to set up a $1 billion fund to clean up contaminated land in the area hasn’t been implemented and both the government and Shell haven taken little action, the report said.

“Three years on and the government and Shell have done little more than set up processes that look like action but are just fig-leafs of business as usual,” according to the report published by Amnesty and Friends of the Earth.

Nigeria’s oil minister Diezani Alison-Madueke on September 19 admitted that three years after it was launched, the government has yet to set up an independent authority as recommended by the study to disburse the money.

A deal for OML 11 may have to involve local players as part of the federal government’s strategy for building up nationally owned oil and gas production capacity.

Russia’s Rosneft “continues work on the transaction” to acquire the oil trading unit of Morgan Stanley, a spokesman for Russia’s largest oil producer said Thursday, commenting on media reports that suggested the deal could be canceled due to Western sanctions.

The spokesman declined to say if Rosneft still expects the deal to close by the end of the year, as Morgan Stanley’s top officials had stated earlier. Morgan Stanley declined to comment on the progress of the deal.

The transaction received approval from the European Commission in early September and is now awaiting a go-ahead from the US Committee on Foreign Investment in the US, which investigates transactions for national security risks. US antitrust regulators have already approved the sale.

Despite the approvals, some analysts have said the deal could be derailed by Western sanctions imposed against Rosneft and its CEO Igor Sechin over Russia’s role in the crisis in Ukraine. The concerns intensified in mid-September when the White House toughened its sanctions against Russia, forbidding US companies from issuing new debt with a maturity of more than 30 days to a number of Russian banks, energy companies and arms producers, with Rosneft on the target list.

Rosneft and Morgan Stanley reached an agreement on the bank’s oil trading unit last December. The deal includes sale agreements for international oil terminal storage and inventory, physical oil purchase, sale and supply agreements, equity investments, and freight shipping contracts.

Overall loadings of Urals crude oil from the Baltic Sea ports of Primorsk and Ust-Luga and from the Black Sea port of Novorossiisk are set to climb a combined 196,000 mt (1,417,080 barrels) in October, according to a provisional full-month loading schedule seen by Platts Thursday.

Total export volumes are set to come in at 8.1 million mt (58,563,000 barrels) with average loadings of 1,889,129 b/d out of the three ports, down 15,735 b/d from September.

Exports are set to increase by 200,000 mt out of the Baltic Sea port of Primorsk, which typically sees the largest volume of exports of the three main terminals each month. Loadings are currently scheduled at 3.6 million mt, their highest level since July, at a loading rate of 839,613 b/d, up 20,213 b/d from September.

The final, signed loading program was 3.4 million mt in September after a 100,000 mt Primorsk cargo was excised between the release of the full provisional schedule and the final version last month.

Loading schedules may be subject to change. Some 36 cargoes of 100,000 mt are set to load out of Primorsk in October, down from the 34 scheduled in September. some 21 cargoes of 100,000 mt each are scheduled to load out of nearby Ust-Luga, bringing the total expected export volume from the port to 2.1 million mt in October at a rate of 489,774 b/d.

The final September schedule was 2.2 million mt with an average daily loading rate of 530,200 b/d, the longest program for the port since May. There are no free positions in either Baltic Sea loading program in October.

A free position is a laycan within the program to which no crude oil has yet been assigned, resulting in a so-called hole. Free positions may subsequently be replaced with a cargo, but are often left unfilled. Exports are also set to rise out of the Black Sea port of Novorossiisk, increasing 96,000 mt to 2.4 million mt, making the provisional October schedule for the terminal the longest since June.

The loading rate is set to tick upwards by 4,478 b/d to 559,742 b/d in the second month of increases after August’s program ultimately proved to be the shortest for the Black Sea port since at least January 2012.

Italy’s Eni has been awarded three new exploration licenses by the Egyptian government under the country’s latest oil and gas licensing round, the company said Thursday.

“The new licenses will be formally awarded soon, after the ratification and finalization of the concession agreements”, Eni said in a statement.

The Italian company will take a 100% interest and operatorship of the 2,058 square km onshore southwest Melehia block in the western desert, which was awarded by state-owned Egyptian General Petroleum Corp.

Eni was also awarded the operatorship of two blocks — 8 and 9 — by state-owned Egyptian Natural Gas Holding Company, located offshore in the Mediterranean near the maritime border with Cyprus.

Egypt ratified a unitization agreement with Cyprus on September 12 defining the rules of cooperation between the two countries for the development and joint exploitation of hydrocarbon reserves at the border. Eni will hold 100% equity in Block 9, also named North Leil Offshore, which covers an area of 5,105 square km in water depths ranging from 2,100 to 2,800 meters.

It will partner the UK’s BP at Block 8, also known as Karawan Offshore, with both companies holding a 50% equity interest. This license covers an area of 4,565 square km in water depths ranging from 2,000 to 2,500 meters. Egypt said over the weekend it had awarded seven oil blocks, including two in the Gulf of Suez to Germany’s RWE Dea.

The remaining awards were to Italy’s Edison International, Tunisia’s HBS and Canada’s TransGlobe for a total of five onshore Western Desert blocks.

Lifters of Iraq’s Basrah Light crude oil have nominated to load 2,439,516 b/d, in October, or 75.625 million barrels, about 6,000 b/d higher than preliminary nominations published earlier in the month, the latest loading schedule received by Platts from sources showed Thursday.

September nominations were at 2.307 million b/d. The two oil-loading terminals at the port — Basrah Oil Terminal and Khor Al Amaya Oil Terminal — will export a total of 75.43 million barrels in October, which has 31 loading days.

The buyers scheduled to load Basrah Light in October include Hindustan Petroleum Corp. Ltd, Litasco, Al Waha, Sinochem, Unipec, Petrobras, Petronas, Shell, GS Caltex, Motor Oil, Zhenhua Oil, Indian Oil Corp., Toyota, Bharat Oman Refinery Limited, HMEL, Petrochina, ERG, BP, Cepsa, Valero, Gunvor, Petrogal, ExxonMobil, SK Energy, Repsol, Pertamina, China National Offshore Oil Corp, Total, Kogas, Occidental, Saras, Chevron, Shell and Eni.

The easing of tensions in Ukraine will offer little respite to Russia as the lowest oil prices in more than two years threaten to tilt the $2 trillion economy toward recession, according to a Bloomberg survey of analysts.

Russia needs Urals, its main export crude blend, to trade at $100 per barrel or higher to avoid a recession, according to 58 percent of respondents in a survey of 19 economists. Given the level of U.S. and European sanctions over Ukraine, at least 19 percent of analysts said the current price is sufficiently low to put Russia’s financial stability at risk.

The decline in oil prices is exacting a toll on the world’s biggest energy exporter, which gets about half of its budget revenue from oil and natural gas sales. That’s limiting Russia’s ability to withstand sanctions by exhausting public finances as the non-oil deficit, the shortfall excluding revenue from the energy industry, exceeds 10 percent of economic output.

“Even if the oil price should recover to low three-digit prices again, Moscow’s hands are rather tied -- the budget is already ailing and the potential funding needs of the banking system could quickly eat up all free resources,” Wolf-Fabian Hungerland, an economist at Berenberg Bank in Hamburg, said by e-mail. “And its rainy day fund is just too small to be a game changer.”

Demand Slumps

Futures of Brent crude, used to price about half of the world’s oil including Urals, declined about 14 percent in the past three months, falling to a two-year low on Sept. 15. Global oil-demand growth is the slowest since 2011, while the U.S. shale boom means oil production outside OPEC is rising by the most since the 1980s, according to the International Energy Agency.

Urals prices fell below $100 a barrel on Aug. 18 and averaged $98.28 from Aug. 15 to Sept. 14, according to Russian Finance Ministry adviser Alexander Sakovich. This was the first time the average price for a month was below $100 a barrel since June 2012, according to the ministry.

The budget for next year is based on a price of $96 per barrel, Maxim Oreshkin, head of strategic planning department at the Finance Ministry, said Sept. 16.

The government predicts the budget will run a deficit of 0.6 percent of gross domestic product in 2015.

A $1 drop in the price of oil deprives the budget of about 80 billion rubles ($2.1 billion) in revenue, according to Oreshkin, while a 1 ruble increase in the dollar’s exchange rate boosts income by about 200 billion rubles.

Sharp Spike

Russia’s dependence on oil grew “sharply” in 2013, First Deputy Finance Minister Tatiana Nesterenko said Sept. 12 on Facebook. The non-oil deficit grew to 10.3 percent of GDP in 2013, the highest since 2010, showing “Russia is dependable on external factors” she said.

The budget squeeze threatens to exacerbate the economy’s worst performance since a 2009 recession. GDP will expand 1 percent in 2015, according to the median estimate of 36 economists in a separate Bloomberg survey, down from 1.3 percent predicted last month.

The probability of a recession within the next year decreased to 60 percent from 65 percent last month, according to the median estimate of 27 economists.

The standoff over Ukraine has also spurred capital flight, undercut the ruble and choked access to credit abroad. The ruble has lost more than 14 percent against the dollar this year, the second-worst performer among 24 emerging-market currencies tracked by Bloomberg.

“Russia can go into recession even with Urals at $110 a barrel if Russian borrowers remain cut off from world capital markets for a long time,” said Tatiana Orlova, economist at Royal Bank of Scotland in London.

By Dan Murtaugh and Moming Zhou Sep 26, 2014 3:33 AM GMT+0700

Refinery breakdowns have pushed wholesale gasoline in the Gulf Coast to the highest level since July, halting a drop in pump prices across the U.S.

Gasoline in the Gulf, home to more than half of U.S. refining capacity, has jumped 20 cents a gallon in the past two weeks. October-delivery futures contracts, the benchmark for gasoline sold across the country, are the highest this month. U.S. retail prices, which tend to lag behind moves in the spot and futures markets, have risen 0.7 cent in three days, after falling every day since Sept. 5.

Prices have climbed as refineries in eastern Canada and Texas have been forced to shut units for unplanned repairs at a time when other plants are conducting seasonal maintenance. Hedge funds and other speculators were the most bearish in four years as of Sept. 16, adding fuel to the rally.

“Clearly the tightness is a result of significant FCC works, largely unplanned,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. “If you combine that with the number of shorts in the gasoline market, which were very high as well, it means that you are seeing a very strong rally.”

October gasoline gained 5.42 cents, or 2 percent, to $2.718 a gallon today on the New York Mercantile Exchange. The spread between first- and second-month contracts rose 2.67 cents to 17.82 cents a gallon, the biggest gap in almost two years.

Retail gasoline strengthened for the third day in a row, up 0.1 cent to $3.345 a gallon, according to Heathrow, Florida-based AAA.

Lower Supplies

Gasoline supplies in the Mid-Atlantic region, which includes New York, the delivery point for Nymex futures, have dropped three consecutive weeks to 10 percent below a year ago, as Irving Oil Corp. and North Atlantic Refining Ltd. have cut production at refineries in eastern Canada.

Irving’s Saint John plant in New Brunswick, which ships about half of its fuel production to the northeast U.S., shut an alkylation unit on Sept. 23, Genscape Inc. reported yesterday. A crude unit and fluid catalytic cracker are also shut.

North Atlantic’s Come By Chance refinery in Newfoundland shut units for a month of maintenance during the first week of September.

October Premium

October futures were already at a premium to contracts for later delivery at the beginning of September as the market transitioned from summer-blend to winter-blend gasoline. On Sept. 15, the Environmental Protection Agency allows retailers to start selling winter gasoline, which can have higher higher vapor pressure and therefore contain more lower-cost butane.

“By nature the market is backwardated, so there are lean inventories as it is,” said Eric Rosenfeldt, vice president of supply and trading at Papco Inc. in Virginia Beach, Virginia. “You add to that Irving and Come by Chance, whether because of turnarounds or other issues, you take that supply out of the market, and you’ve got problems.”

Money managers were net-long 8,277 contracts of futures and options as of Sept. 16, the fewest since September 2010, Commodity Futures Trading Commission data show.

Gulf Coast conventional gasoline rose 1.5 cents to 14.5 cents above Nymex futures today, the highest since Sept. 26, 2012. Reformulated gasoline in New York jumped 2.38 cents to 9.63 cents a gallon above futures.

Offline Capacity

The amount of fluid catalytic cracking capacity offline in Texas is at the highest level for this time of year since at least 2011, data compiled by Bloomberg show. The units break down vacuum gasoil to produce fuel including gasoline and diesel.

Companies including Alon USA Energy Inc., Exxon Mobil Corp. and Citgo Petroleum Corp. have reported equipment failures just as plants from Marathon Petroleum Corp.’s Galveston Bay complex to Phillips 66’s Sweeny site shut units for scheduled repairs.

“The physical markets are relatively tight,” said Phil Flynn, senior market analyst at Price Futures Group in Chicago, said by telephone today. “We had four glitches just yesterday. It’s set off a bit of a panic.”

Plentiful oil supplies are pinning oil prices near a two-year low as the U.S. extends its campaign against Islamic State militants into Syria.

Brent crude, which has traded below $100 a barrel for more than two weeks, touched $95.60 a barrel yesterday, the lowest since July 2012, after the broadest Arab-U.S. military coalition since the 1991 Gulf War struck Islamic State targets in Syria. U.S. aircraft began bombing the group six weeks earlier in Iraq, OPEC’s second-largest producer and holder of the world’s fifth-biggest reserves.

“The impact for oil prices from the U.S. airstrike is effectively zero,” Giovanni Staunovo, an analyst at UBS AG in Zurich, said yesterday by e-mail. “The market focus has shifted from supply risks to oil glut fears to weak oil demand from China, Europe and Japan.”

An increase in global crude supply that prompted the Organization of Petroleum Exporting Countries to consider cutting its production target is helping to calm markets in the face of potential output disruptions, according to the International Energy Agency. Oil demand is growing at its slowest since 2011, while the U.S. shale boom means production outside OPEC is rising by the most since the 1980s, the Paris-based IEA said in a monthly report Sept. 11.

Coordinated Action

Brent for November settlement rose 5 cents to close at $97 a barrel on the London-based ICE Futures Europe exchange today.

Iran’s oil minister, Bijan Namdar Zanganeh, told reporters in Tehran today that U.S.-led airstrikes probably won’t affect prices.

U.S., Saudi Arabia and United Arab Emirates warplanes attacked 12 modular oil refineries yesterday in eastern Syria controlled by Islamic State, U.S. Central Command said in an e-mailed statement. The strikes against the refineries are the latest by the U.S. and its allies, which also include Jordan, Bahrain and Qatar. Earlier attacks struck an Islamic State finance center.

“The current attacks won’t in the short term defeat ISIS,” Gala Riani, a Middle East analyst at consultants Control Risks in London, said yesterday by phone, using a former acronym for Islamic State. “In Iraq they’ve already shifted tactics, for example, by moving in smaller groups to avoid attack, and they will probably also do so in Syria.”

Southern Exports

Brent, a benchmark used to price more than half the world’s oil, surged to a nine-month high in June after the militants emerged from Syria, where they had seized land and oil fields, to capture large parts of northern Iraq.

While fighting in Iraq has spurred companies including BP Plc (BP/) and Exxon Mobil Corp. (XOM) to evacuate workers from the country since June, the country pumps and exports most of its crude from its Shiite-dominated southern region, where Islamic State’s Sunni insurgency has had little impact. The conflict has largely spared the south, home to about three quarters of Iraq’s oil production according to the U.S. Energy Information Administration.

Iraqi oil exports will increase this month to 2.5 million barrels a day, up 5.5 percent from August, because of better stability of shipments from southern terminals, Abdul Ilah Qassim, an adviser to the government’s Council of Ministers, said by phone yesterday.

Kurdish Pipeline

“There is limited amounts of infrastructure that the Islamic State could easily reach out and attack that it doesn’t already control, even if it wanted to retaliate,” Richard Mallinson, an analyst at Energy Aspects Ltd. in London, said yesterday by phone.

Iraq’s export pipeline from northern oil fields into Turkey has been out of operation since March 2, and the central government now exports all its crude by sea from southern terminals. The semi-autonomous Kurds of northern Iraq are producing crude and exporting it without the government’s approval through their own pipeline to Turkey.

“Most of the production in the regions controlled by Islamic State is already lost to the market,” Mallinson said. “Syrian production was lost several years ago early in the civil war there, and Iraqi production in the north has been shut in or disrupted for several months now.”

Syria produced 56,000 barrels a day of crude in 2013, while Iraq pumped 3.141 million that year, according to data from BP. Syria’s crude reserves of 2.5 billion barrels are a fraction of Iraq’s 150 billion, the data show.

U.S. Fracking

U.S. crude production climbed to 8.87 million barrels a day last week, the highest level since 1986. A combination of horizontal drilling and hydraulic fracturing, or fracking, has unlocked supplies from shale formations.

“The perception that we are facing a well-supplied market now, partly because of rising U.S. production, means there is a lot less concern about problems with oil supply disruption,” Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts, said yesterday.

Concerns for the long term remain, Mallinson said. Non-state armed groups in the Middle East and North Africa, including Libya, with Africa’s biggest oil reserves, continue to wield military might and challenge the authority of governments.

“At the moment there’s not so much impact for prices because there’s no distortion of supplies yet, but it is destabilizing the situation in the whole region,” Eugen Weinberg, head of commodities research at Commerzbank AG, said yesterday by phone from Frankfurt. “The real concern is whether Islamic State will infiltrate Sunni states like Saudi Arabia -- then it’s a grave danger.”

Norway’s Statoil ASA (STL) has postponed work on its Corner field project in the Canadian oil sands as mounting costs reduce the potential for profit.

Statoil plans to delay the project in northern Alberta by at least three years and expects to cut 70 jobs, the company said today on its website. The decision doesn’t affect the company’s Leismer operations with capacity of 20,000 barrels a day.

“The decision is in line with Statoil’s strategy to prioritize capital to the most competitive projects in its comprehensive global portfolio and is consistent with our stepwise approach to the oil sands,” Statoil Canada President Staale Tungesvik said in the statement.

The Stavanger, Norway-based company is the most recent to postpone an oil-sands project amid rising costs. Total SA (FP) in May said it would cut 150 jobs at its Joslyn project and delay a final investment decision as costs escalate.

Oil-sands producers have struggled with rising costs in the remote projects in northern Alberta because of labor shortages and difficulties in getting equipment. Imperial Oil Ltd., the Calgary-based producer majority owned by Exxon Mobil Corp. (XOM), last year boosted the cost of its Kearl project by 18 percent.

Pembina Pipeline Corp. (PPL), a Calgary-based oil conduits operator supplying lines for the Statoil project, said its contract with the Norwegian company concerning the delayed operation expires at the end of the month. The engineering may be used for “other commercial discussions,” Pembina said in a statement today.

Houston (Platts)--25Sep2014/641 pm EDT/2241 GMT

The October start of a new pipeline project pushed price differentials for Bakken injected to the storage hub in Guernsey, Wyoming, to their highest level in nearly five months Thursday.

Spot prices jumped with expected deliveries from Tallgrass Energy Partners' 230,000 b/d Pony Express pipeline, which runs from Guernsey to Cushing, Oklahoma.

Bakken at Guernsey was assessed at the calendar month average of NYMEX light sweet crude (WTI CMA) minus $3/b, a $1.70 climb from Thursday. That is its highest value since being assessed at WTI CMA minus $2.90/b on May 5.

Traders said strength in Guernsey was also coming from an already active market for Bakken sold into Cushing. Bakken at Cushing was heard bid at WTI CMA plus $1.60/b and offered at WTI CMA plus $2.25/b.

Strength from Guernsey trickled into the market for its counterpart in Clearbrook, Minnesota, which was assessed 70 cents higher at WTI CMA minus $3.90/b.

Tallgrass said late Thursday it has proposed expanding the Pony Express system to as much as 400,000 b/d in 2016, depending on interest from shippers.

The company said it would also expand its gathering and transportation in the Niobrara and Codell formations in Colorado and Wyoming.

Yuzhno-Sakhalinsk (Platts)--24Sep2014/1143 pm EDT/343 GMT

The deal between Russia and China for importing some 38 billion cubic meters/year of natural gas through a pipeline connecting the two countries represents a key development not only for the two parties involved, but also for the role it will have in shaping the global price of LNG, according to Shigeru Muraki, vice chairman of the board at Japan's Tokyo Gas.

Speaking at the Adam Smith Sakhalin Oil and Gas 2014 conference in the Russian Far East late Wednesday, September 24, Muraki said that the many LNG export projects coming on stream in the next years in countries such as Australia, Russia and the US will not only have to compete between each other for demand, but also against the price set by pipeline imports deals such as the one between Russia and China, which has an estimated price of around $12/MMBtu.

Russia is set to export up to 38 Bcm/year of natural gas from fields in East Siberia to China over a 30-year period starting after 2018 through the Power of Siberia pipeline, of which construction started earlier in September.

Muraki said the coming years will be an "interesting time" for "gas markets in Asia, with more opportunities for suppliers and buyers" however many new projects coming on stream will have to compete for demand, with price being a key factor.

"Russia will take up a key role to provide supply through LNG and pipeline" he said, adding that meanwhile, Japanese buyers were now looking at diversifying gas supply sources and contracts towards a combination of long-term, short-term and spot contracts and were looking at prices based on the US Henry hub and UK NBP hub, beside traditional oil-indexed contracts.

Comparing production costs for international planned LNG projects and pipeline projects, he said that the expansion of Sakhalin-2 project as well as the Russia-Japan pipeline showed the most competitive price terms, against LNG exports from Australia and Russia's Vladivostok.

Muraki said that some 20 million mt of gas demand will disappear from the Japanese market in the next two to three years, due to the planned restart of several nuclear power plants in the country.

However, the capacity of nuclear plants is set to decrease from 2020 onwards as they approach the end of their lifetime, creating scope for a potential increase in natural gas demand up to 100 million mt of LNG equivalent per year, in a scenario of increased price competitiveness and Henry Hub indexation.

Tokyo Gas is the first buyer of Russian LNG coming from the Sakhalin-2 terminal under a 24-year long-term contract which started in 2009.

Commenting on the recent round of sanctions against Russia, he told Platts that in the short-term it's however difficult to commit to new Russian LNG supplies.

"At this moment because of the sensitivity of sanctions, it is hard to make a new commitment to take Russian LNG volumes," Muraki said.

CHINA DEMAND DEPENDENT ON DOMESTIC SHALE

Meanwhile, natural gas demand growth in China, a key market for new suppliers, is highly dependent on the scope of its shale gas production in the coming years, according to Keun-Wook Paik, senior research fellow at the Oxford Institute for Energy Studies.

Paik said shale gas production in 2015 in China was estimated at around 6.5 Bcm, however there was uncertainty on the potential growth to 2020, with estimates ranging between 30 Bcm/year to up to 100 Bcm/year.

He added that without a "breakthrough in the shale gas revolution" in China, "the gap of gas demand and supply will be significant" with total demand estimated at 550 Bcm/year and total domestic production at 300 Bcm/year.

He said of the remaining, some 160 Bcm/year are expected to come from pipeline gas imports and 90 Bcm/year from LNG imports.

Besides the deal for East Siberian gas, imports of another 30 Bcm/year have been agreed between the two countries, which "will put big pressure on LNG on suppliers," Paik said.

"That's the dilemma faced by suppliers, how much market will be available" he said, adding that given the pipeline deal "any LNG supply above $12/MMBtu" cannot compete, at least for supplying the northern provinces in China.

Singapore (Platts)--25Sep2014/454 am EDT/854 GMT

The ex-refinery jet fuel prices at which China National Offshore Oil Corporation, PetroChina and Sinopec will supply to China National Aviation Fuel are expected to fall for a fourth straight month in October by about Yuan 205.79/mt ($33.46/mt) from September, according to Platts estimates.

The three suppliers' reference ex-refinery jet fuel ceiling prices for October are expected at Yuan 6,599.96/mt, excluding a premium of Yuan 30/mt, according to Platts calculations.

The premium is negotiated between CNAF and its three suppliers on an annual basis.

The estimated drop reflects a month-on-month fall of Yuan 205.79/mt in the post-tax price of imported jet fuel to an average of Yuan 6,629.96/mt from August 25-September 24 -- the National Development and Reform Commission's review period for September -- according to Platts calculations.

Under the current pricing mechanism established in July 2011, the NDRC sets a cap on ex-refinery jet fuel prices on the first day of every month based on the post-tax import price -- which comprises the Platts monthly average FOB Singapore jet fuel price, freight from Singapore to China and insurance at $2/barrel, VAT of 17% and port dues totaling Yuan 50/mt.

The ex-refinery prices are not allowed to exceed the post-tax import costs of jet fuel shipped from Singapore.

NDRC's review period for setting the subsequent month's ex-refinery jet fuel prices is from the 25th day of the previous month to the 24th day of the current month, unless these dates fall on a weekend or public holiday.

According to Platts data, over August 25-September 24 the Mean of Platts Singapore jet fuel/kerosene price averaged $113.63/b, or $897.69/mt, down $3.55/b from the previous review period, reflecting a $4.64/b drop in the benchmark ICE Brent crude futures in the review period to average $99.83/b.

Adding to that, the surplus barrels of jet fuel/kerosene from China and the Middle East continued to outweigh steady demand for the grade, locking the weak price in the region.

Jet fuel/kerosene exports from China over January-August increased 10.8% year on year to 6.45 million mt, according to latest data from the General Administration of Customs.

Kurds call for action against terror oil

ERBIL, Iraq, Sept. 25 (UPI) -- The Kurdish government said Thursday it was calling on military forces to take tough action against oil smuggling from areas under terrorist control.

Military air strikes on terrorists groups in Syria Wednesday targeted 12 oil refineries used by Islamic State terrorists to generate as much as $2 million per day.

The Kurdish Ministry of Natural Resources said in a statement issued through its official Twitter account action must be taken to contain oil's role in IS financing through action by the Kurdish Peshmerga and other forces.

The Iraqi Ministry of Oil issued an appeal to U.N. member states to take action to prevent the export of smuggled crude oil. The ministry said it was troubled by reports that crude oil taken from territory controlled by the Sunni-led terrorist group was reaching the international market.

President Barack Obama said air strikes against regional terrorist targets were the foundation of a strategy that will "degrade, and ultimately destroy" the terrorist group.

Kevin Martin, executive director for U.S. advocacy group Peace Action, said cutting oil ties to Islamic State terrorists was an effective non-military means to control the threat.

Kremlin ready for energy company bailout

MOSCOW, Sept. 25 (UPI) -- Russian energy companies feeling the squeeze from Western economic sanctions can appeal for help from the government, the deputy energy minister said Thursday.

Russia relies heavily on oil and natural gas revenues to support its economy. When sanctions targeting Russian energy companies went into force earlier this year, Andrei Belousov, an economic adviser to the Kremlin, said the Central Bank of Russia may sell some of its foreign currencies to blacklisted companies in an effort to offset the punitive measures.

Deputy Energy Minister Kirill Molodtsov said Thursday the federal government was on standby should sanctions-strapped companies need support.

"In a situation when the companies came under sanctions, they can appeal to the government for support, if there is such a need," he said.

The European Bank for Reconstruction and Development said last week sanctions were taking a toll on the Russian economy.

Russian Prime Minister Dmitry Medvedev said efforts must be made to keep inflation at the lowest rate possible.

Oil and shipping giants offer $1.5M to counter Somali pirates

THE HAGUE, Netherlands, Sept. 25 (UPI) -- A joint initiative led by leading oil and shipping companies said Thursday they were donating $1.5 million in funds to stem piracy off the coast of Somalia.

The Joint Shipping Initiative, lead by Royal Dutch Shell, BP, Danish conglomerate Maersk, Hungary's MOL, Japanese shipping companies and others, announced the funds were made available through the U.N. Development Fund.

"Piracy is a global problem that takes root in limited economic opportunities, high youth unemployment rates and poor infrastructure," Jens Munch Lund-Nielsen, a sustainability director at Maersk, said in a statement.

Two former U.S. Navy SEALs working for a security firm were found dead in a Maersk Alabama container ship in the Seychelles in February. Somali pirates in 2009 took over the ship, an incident that inspired the 2013 movie Captain Phillips.

The Joint Shipping Initiative said the lack of viable employment opportunities in war-torn Somalia serves as a recruitment tool for pirate leaders.

"Development projects that provide an alternative livelihood to would-be pirates are a vital element of the long-term solution to piracy," Grahaeme Henderson, vice president of Shell shipping and maritime services, said.

Benefits of shale boom spreading, study finds

WASHINGTON, Sept. 25 (UPI) -- A study finding the U.S. energy boom is reaching other economic sectors gives credibility to the industry's stance, the American Petroleum Institute said.

A study from IHS Global Insight, commissioned by the Energy Equipment and Infrastructure Alliance, finds total labor income generated by employment in industries across many aspects of the energy sector supply chain could reach $60 billion in 2025. That's a 46 percent increase from 2012.

"America's rise as an energy superpower is creating an economic ripple effect of fast-paced growth, higher wages, and new jobs," API Vice President for Economic Policy Kyle Isakower said in a statement Wednesday. "API released its own survey of 30,000 vendors and supporting businesses in every single state that that help deliver affordable energy to U.S. consumers."

IHS found the growth spurred by developments in shale drilling technology is offsetting some of the market declines from the last economic recession. API in July found states without much oil production, like Florida, could see as much as $1 billion in economic gains by 2020 because of the boom.

Shale oil and natural gas developments are behind exponential growth in economies in states like North Dakota. A corresponding increase in violent crime there has prompted state authorities to issue an appeal for federal assistance.

China takes on more oil

HOUSTON, Sept. 25 (UPI) -- Chinese demand for oil in August reached a record level despite signs of a slowdown in the economy, analysis from Platts found.

Platts found Chinese apparent oil demand, a reflection of how much oil goes into domestic refineries combined with net oil product imports, averaged 9.74 million barrels per day, a 3.7 increase from August 2013 and the highest level for the year.

The assessment comes despite an economic production growth rate of 6.9 percent, the slowest rate since 2008.

On a month-to-month basis, Platts found Wednesday that Chinese apparent oil demand in August was 1.4 percent above July levels. Through August, demand was up 1.2 percent from last year.

The International Energy Agency in its monthly market report for September trimmed oil demand growth for 2014 to 900,000 barrels of oil per day and 2015 to 1.2 million bpd. IEA said the assessment was made because of a "pronounced slowdown" and weaker outlook for Europe and China.

Platts last month said there was a weakness in Chinese oil demand that reflected an economic slowdown.

Eni tightens production grip in Egypt

MILAN, Italy, Sept. 25 (UPI) -- Italian energy company Eni said Thursday it was the successful bidder in three new onshore and offshore exploration licenses in Egypt.

"I am very pleased with the acquisition of these new exploration permits, which further strengthens our presence in Egypt, a historically and strategically important country for Eni," Chief Executive Officer Claudio Descalzi said in a statement.

The Italian company said the license areas are in Egypt's Western desert and in the deep waters of the Mediterranean Sea.

Eni announced in August it started natural gas production from the offshore Denis-Karawan in Egypt through a partnership with BP.

Peak production of 230 million cubic feet per day is expected by the first quarter of 2015.

The Egyptian government in May said BP is investing $1.5 billion in the oil and gas sector during the second half of the year.

Iran ready for European gas role

UNITED NATIONS, Sept. 25 (UPI) -- Iran can play a central role in the energy security strategy for Europe if it's met with open arms, the Iranian president said from New York.

Iranian President Hassan Rouhani is in the United States to attend a meeting of the U.N. General Assembly. During a meeting with Austrian President Hans Fischer, the Iranian leader said gas installations in western Iran could link to Europe.

"Iran can be a secure energy center for Europe," the Iranian president said.

Iran has held out its natural gas reserves to a European community eager to break Russia's grip on the regional energy sector. It touted its gas as an option to fill the now-shelved Nabucco pipeline through Turkey to Europe, though sanctions have interfered with Iran's ambitions.

Nevertheless, an Iranian president seen as a moderate when compared with his predecessor Mahmoud Ahmadinejad said Iran enjoys a "unique" position in the regional energy sector.

Iran has the second largest deposits of natural gas in the world, though the sector is underdeveloped because of a lack of foreign investments. The country uses more than half of the natural gas it produces.

Energy on agenda for Canada-EU talks

BRUSSELS, Sept. 25 (UPI) -- The development of ties in the energy sector is on the table for bilateral talks with Canadian officials, leaders from the European Union said.

European Council President Herman Van Rompuy and European Commission President Jose Manuel Barroso head Friday to Ottawa for an annual summit hosted by Canadian Prime Minister Stephen Harper and trade representatives.

European leaders said the visit is a chance to reflect on the success of negotiations on strategic partnership and comprehensive economic and trade agreements.

With Harper joining the chorus of voices frustrated with regional developments in Iraq, Syria and Ukraine, Van Rompuy said Wednesday the talks were an opportunity to build a stronger policy foundation.

Bilateral agreements reinforce cooperation "most obviously" in international peace and security, he said, "but also in areas like education, transport, energy, environment, the Arctic or science and technology, where Europeans and Canadians stand to benefit greatly from closer cooperation."

The Canadian government is working to diversify an energy sector dependent almost exclusively on the United States for oil exports. Harper's administration has deals in hand for gas deliveries to Asian markets and delegates last year tried to generate European interest in its oil sector.

Canada's Natural Resources Ministry last year said European emissions standards on the heavier grade of crude oil found in Canada were "unscientific and discriminatory."

New refineries will boost Saudi share of petroleum products market: experts

Refineries expected to produce a total of 800,000 bpd of refined products such as diesel

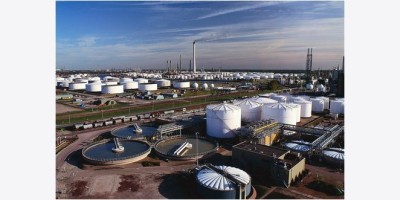

http://www.aawsat.net/wp-content/uploads/2014/09/Saudi-Aramco.jpg

This file photo shows oil tanks at the Saudi Aramco headquarters during a media tour at Damam city, Saudi Arabia, on November 11, 2007. (Reuters/Ali Jareki/Files)

Al-Khobar, Asharq Al-Awsat—The opening of two new oil refineries in Saudi Arabia will help the Kingdom maintain and grow its share of the global crude and petroleum products markets, sector experts have told Asharq Al-Awsat.

The SATORP Jubail Export Refinery, owned by Saudi Aramco Total Refining and Petrochemical Company (SATORP)—a joint venture between the Kingdom’s state-owned oil company Saudi Aramco and global oil and gas giant Total—began refining operations on August 1, according to Total’s head of refining and chemicals, Patrick Pouyanné, who was speaking to the Reuters news agency on the sidelines of the European Refining Conference in Brussels on Tuesday.

The Yanbu Aramco Sinopec Refining (Yasref) project, a joint project between Saudi Aramco and Chinese oil and gas producer Sinopec, began initial test runs earlier this month, according to Saudi Aramco’s chief executive, Khalid Al-Falih, who was speaking at a conference in Tianjin in China last week.

Both refineries will convert up to 400,000 barrels per day (bpd) of 100-percent Arabian Heavy Crude to lighter petroleum-based products, with the Yasref refinery turning out gasoline, diesel and liquefied petroleum gas (LPG), and SATORP producing diesel and jet fuel.

A informed source, who requested anonymity because he was not authorized to brief the media, told Asharq Al-Awsat that once both refineries were fully operational, the Kingdom should expect to “export larger amounts of refined petroleum products, which would give it much more weight in . . . [this] market and not just the crude oil market.”

Official figures obtained by Asharq Al-Awsat show that refining activity in the Kingdom jumped to 1.95 million bpd on average during the first half of 2014, up from 1.54 million bpd during the same period last year. Figures for August and September are as yet unavailable.

Experts said they expect both refineries together with the Ruwais refinery due to open in the UAE early next year to altogether produce an additional 1 million bpd of refined petroleum products coming from the Middle East, particularly diesel.

Refined products from SATORP began exporting at the end of last year, while output from Yasref is expected to hit export markets by the end of this year.

Less than 6 percent of SATORP exports will reach European markets, however, according to an official from Total, who also said most of the output would be exported to Asia, east Africa and other parts of the Middle East.

This comes as Saudi oil exports declined recently on the back of reduced demand for crude from the US and declining profit margins from refined Arabian Light Crude in Asian markets. However, observers predict an uptick in exports due to the large discounts being offered by Saudi Aramco to buyers during September and October.

Observers are also watching the Saudi market closely after global oil prices fell below 100 US dollars per barrel for the first time in over a year earlier this month, worried that a possible rise in production from the world’s leading oil producer could push prices further down. But OPEC figures showed Saudi oil production had decreased in August by around 400,000 bpd from its daily output of 10.01 million bpd in July, with most analysts putting this down to reduced demand for exports rather than the annual dip in domestic demand following the end of the summer season.

OPEC countries, which in addition to Saudi Arabia also include Libya, Iraq, Qatar, the UAE, Iran, Venezuela and Angola, together produce around 30.3 million bpd of crude, but it is expected, following comments made last week by the group’s secretary-general that this will be lowered in the fourth quarter of the year by around 500,000 bpd in order to avoid building up a surplus and pushing prices further down and away from the critical 100 dollar per barrel mark which OPEC countries rely on oil prices staying above in order to regulate their budgets.

© Copyright 2013 Asharq Al Awsat

Arab News

JEDDAH: Saudi Arabia is likely to keep its oil output steady throughout the rest of the year as world oil consumption is expected to rise and domestic demand for crude eases during the winter.

Oil prices have slid on ample supplies and concern about weakening demand on slowing economic growth in Europe and China, raising the question of whether Saudi Arabia will curb output to support prices.

But industry sources in Saudi Arabia said the Kingdom will continue with its basic policy of supplying the market according to needs.

Riyadh had always said that it adjusts oil supply to accommodate its customers and not to drive the price.

The top exporter and holder of the world’s largest spare capacity cut its output by around 400,000 barrels per day in August.

But the amount of crude supplied to the market — both domestically and for export — inched up to 9.688 million bpd, compared to around 9.66 million bpd in July, indicating no change in Saudi oil supply policy.

“

“

Industry observers see Saudi crude output at around 9.5 million to 9.6 million bpd in the coming months when seasonal demand picks up.

˝

Oil prices rose on Thursday to around S97 a barrel, but were not far from the lowest since July 2012 reached the previous day as abundant supply and a strong dollar weigh on prices. Libya’s oil output has risen in recent weeks, while Iraq continues to produce without interruption despite the fighting there.

Petroleum and Mineral Resources Minister Ali Al-Naimi has played down concerns about the fall in prices below $100 and said it was too early for OPEC to act.

Other Gulf oil ministers and delegates have bet on expected rising demand as winter approaches.

“

© Copyright of Arab News 2014

Sep 25 2014 18:30

Tobruk - Libya's oil output has risen further, pushing world oil prices lower, defying the chaos of more fighting between the factions that divide the country and a government driven from the capital.

Crude output has reached 925 000 barrels per day (bpd), a spokesperson for the National Oil Corporation (NOC) said on Thursday, the highest since before militias turned on each after the overthrow of Muammar Gaddafi.

Oil production had fallen as low as 200 000 bpd at times over the last year due to protests and port blockades, but has been recovering since the summer.

There are still fears Libya could descend into all out civil war, with two parliaments and governments competing for legitimacy.

An armed group seized the capital Tripoli in August, forcing the elected parliament to move to Tobruk, a remote city which has mostly escaped the chaos.

On Thursday a spokesman for Libyan state-backed oil firm Sirte Oil said protesters demanding jobs had blocked the entrance to the company's administrative building at the eastern port of Brega, though its oilfields continued to operate.

Rising output from Libya has contributed to a fall in the international benchmark oil price to a two-year low this week, despite fears of supply disruptions in Iraq and Syria.

Libya's eastern Hariga oil port has also fully recovered from eight months of blockades by protesters, port officials said, and is exporting more than 120 000 bpd.

Hariga, located in Tobruk near the border with Egypt, reopened in April with three other eastern ports, under deal with a group of rebels which had ended a protest to demand regional autonomy.

"We are back to normal. The port is operating normally," Hariga terminal manager Rajab Abdulrasoul told Reuters.

"We just exported one million (barrels) to China."

Hariga was slow to restart as the connecting Sarir and Messla fields needed to increase production and a group of security guards started a brief new protest to make financial demands.

Abdulrasoul said the southern Sarir field was pumping around 80,000 bpd. Sarir was running below its capacity of more than 200 000 bpd because the connected eastern Ras Lanuf refinery had not restarted work yet since the end of the rebel blockage, he said.

Some 20 000 bpd was used to feed the Tobruk refinery which supplies the local market and also exports some products mainly to southern Europe.

"The rest is being exported," Abdulrasoul said.

In August, 3.845 million barrels of crude, or around 124 000 bpd a day on average, was lifted from Hariga. In September, 2.72 million barrels, or some 129 000 bpd, left the port until the 21th, the latest port data showed.

Tankers came from Italy, Croatia, Britain, Singapore, Liberia and Malta, according to details provided by the port administration.

Tobruk's refinery, also located at the oil port, exported 77 546 barrels of diesel and 123 026 barrels of untreated naphtha until September 21th, the data showed.

http://i.tmgrup.com.tr/dailysabah/2014/09/25/HaberDetay/1411648802042.jpg

Turkey imported $61 bln worth crude oil in last 5 years

ANKARA — Turkey paid 61.2 billion USD for 87.1 million tons of crude oil imports in the last five years, according to ministry statistics released on Thursday.

The country's total crude oil imports amount 87.1 million tons between 2009 and 2013, according to the Turkish Ministry of Energy and Natural Resources.

Turkey is highly dependent on foreign oil resources as it domestically produces only 10 percent of total demand in the country. Iran is the top supplier, representing 35 percent of total Turkish crude oil imports.

Turkey buys 17 percent of its crude oil from Iraq, as well as 13 and 10 percent from Saudi Arabia and Russia respectively.

Energy imports are a huge burden on current budget deficit of Turkey. Turkey's budget deficit stood at 65 billion USD in 2013.

Copyright © 2014 Tüm hakları saklıdır.

Saudi Arabia sent Egypt $3-billion worth of refined oil products from April up to the first week of this month, an official from Egypt's state oil company told Reuters.

The EGPC official said the total value of oil aid to Egypt from Saudi Arabia since July 2013 through September of this year amounted to $5 billion.

Saudi Arabia, Kuwait and the UAE pledged aid packages worth $12 billion to Egypt immediately following the overthrow of President Mohamed Mursi, providing a badly-needed economic lifeline.

The petroleum aid has not, however, managed to noticeably ease Egypt's energy frequent power cuts, even in upscale areas.

In an effort to combat the energy crisis and encourage new investment to boost local oil and gas output, Egypt has started repaying some of its debt to foreign energy companies, which had reached more than $6 billion.

The petroleum ministry signed oil and gas exploration deals worth $187 million with several Western companies and a Tunisian firm. -- Reuters

Satorp, Total's joint venture refinery in Jubail, Saudi Arabia, reached its full operating capacity of 400,000 barrels per day (bpd) in August, just one of a series of big, complex refineries ramping up over the next year.

The Satorp refinery, which France's Total operates in partnership with national oil company Saudi Aramco, has been operating at its maximum rate since August 1, Patrick Pouyanne, president of the refining chemicals division at Total, said at the 2014 Platts European Refining Summit in Brussels.

"Less than 6 per cent of its output is going to Europe," he added. "This plant is mainly sending its products to the Middle East, Asia and East Africa."

Total previously indicated in a March financial filing that it expected Saudi Aramco Total Refining and Petrochemical (Satorp) to reach full production around the middle of 2014.

Looking ahead, Pouyanne said he did not expect Satorp to send more than 10 per cent of its products to Europe in future.

European refiners are concerned they will face increased competition from new refineries coming onstream in the Middle East and Asia, although some Chinese projects have been put on hold or cancelled.

Total has already indicated that it would like to reduce its refining capacity in France, where it currently operates five plants. A works council meeting on the group's strategy in the refining business is expected to be held on September 25.

In Italy, Eni is also considering rationalisation, stating in early August that it wanted to cut its refining business by more than half. This prompted a one-day strike by some 30,000 Eni workers.

Together, Satorp, Yasref - Saudi Aramco's joint venture with China's Sinopec in Yanbu - and a capacity expansion at Ruwais in the UAE, are expected to add more than one mbpd of refined products to the market, with a strong focus on middle distillates.

"The downstream developments in the Middle East do have pretty significant implications," said Amrita Sen, chief oil analyst at Energy Aspects, also speaking at the summit in Brussels.

She argued that because the Middle East had the advantage of cheaper crudes and a good location, it would mean stiffer competition for European and US refiners in the second half of 2015 in some overseas markets. "They will be a lot more competitive in Africa, for example," she said. -- Reuters

Libya's eastern Hariga oil port has fully recovered from eight months of blockades by protesters and is exporting more than 120,000 barrels per day (bpd), port officials said.

Hariga, located in Tobruk near the border with Egypt, reopened in April with three other eastern ports, under deal with a group of rebels which had ended a protest to demand regional autonomy.

"We are back to normal. The port is operating normally," Hariga terminal manager Rajab Abdulrasoul told Reuters. "We just exported one million (barrels) to China."

The progress at Hariga is part of Libya's oil sector recovery with national production now back to 900,000 bpd, despite the political turmoil that is increasing fears it is edging toward civil war.

Hariga port was slow to restart as the connecting Sarir and Messla fields needed to increase production and a group of security guards started a brief new protest to make financial demands, part of political chaos three years after the ousting of Muammar Gaddafi.

Abdulrasoul said the southern Sarir field was pumping around 80,000 bpd. Sarir was running below its capacity of more than 200,000 bpd because the connected eastern Ras Lanuf refinery had not restarted work yet since the end of the rebel blockage, he said.

Some 20,000 bpd was used to feed the Tobruk refinery which supplies the local market and also exports some products mainly to southern Europe.

"The rest is being exported," Abdulrasoul said.

In August, 3.845 million barrels of crude, or around 124,000 bpd on average, was lifted from Hariga. In September, 2.72 million barrels, or some 129,000 bpd, left the port until the 21th, the latest port data showed.

Tankers came from Italy, Croatia, Britain, Singapore, Liberia and Malta, according to details provided by the port administration.

The oil industry remains vulnerable to protests as the government is unable to control former rebels who helped oust Gaddafi.

An armed group seized the capital Tripoli in August, forcing the elected parliament to move to Tobruk, a remote city which has mostly escaped the country's chaos.

Tobruk's refinery, also located at the oil port, exported 77,546 barrels of diesel and 123,026 barrels of untreated naphtha until September 21th, the data showed. -- Reuters

Thursday, 25 September 2014 17:01

Iraqi Kurdistan has shipped a total of nineteen tankers carrying 13.7 million barrels of crude oil since May via a pipeline to Turkey's Mediterranean port of Ceyhan, a Turkish energy official told Reuters on Thursday.

"The flow of Kurdish oil continues without any issues. The 20th tanker will be loaded in the coming days," the official said, adding that the storage tanks in Ceyhan currently held 445,000 barrels of oil.

Turkey's state-run lender Halkbank, where buyers of the Kurdish oil make their payments to, holds $400 million for the sold oil, Turkish Energy Minister Taner Yildiz told reporters on Wednesday.

"This is a business in which so far $1.3 billion worth of revenues have been made," Yildiz added.

The Kurdistan Regional Government (KRG) began exporting oil in May via its independent pipeline, linking up with the existing Iraq-Turkey pipeline on the Turkish side of the border.

Baghdad strongly rejects the KRG's independent oil exports through Turkey and has launched a series of legal cases to try to halt the sales.

The Kurds argue they hold the right to sell oil under Iraq's constitution.

Copyright Reuters, 2014

http://www.brecorder.com/images/2014/09/rosneft0.jpg

Rosneft, Russia's biggest crude oil producer, may back out of a deal to buy Morgan Stanley 's oil trading unit because Western sanctions make it virtually impossible to finance day-to-day operations, three sources close to the state-controlled company said.

The people said the chances of the deal going through range from "possible" to "highly unlikely." A spokesman for Rosneft said that "the work over the deal is still ongoing."

The business in question trades actual barrels of oil instead of just contracts linked to the price of crude. Morgan Stanley is under U.S. pressure to sell the unit because regulators regard physical oil trading as too risky for a major bank to own because unpredictable events like oil tanker leaks could expose it to billions of dollars in liability.

A spokesman for Morgan Stanley declined to comment. Ruth Porat, the bank's chief financial officer, said in July she expected the deal to close later this year. Rosneft declined official comment.

Rosneft agreed to buy the unit in December. Since then, the United States and the European Union have imposed wide-ranging sanctions on Russia's energy and military sectors to punish Moscow for its incursion into Ukraine.

Rosneft's chief Igor Sechin, a close ally of Russian President Vladimir Putin, has been on the U.S. sanctions list since April. Rosneft itself was added to the list in July.

Rosneft has enough cash to buy the Morgan Stanley unit, which sources said carries a price tag of between $300 million to $400 million. But to operate day-to-day, the business requires billions of dollars of bank lines of credit, funding that is difficult to secure given the sanctions.

Reuters could not learn the precise size of these credit lines, but trading houses that compete with Morgan Stanley such as Vitol, Mercuria and Trafigura each have $30 billion to $40 billion worth of credit lines with dozens of banks.

"This deal just cannot go through. It is not an issue of finding $300 million to buy the business. Rosneft has the money. But it won't be able to operate it," one Russian-based source with direct knowledge of the matter said.

One remaining obstacle for the deal is approval from the Committee on Foreign Investment in the United States, a regulatory group that vets mergers and acquisitions that may affect U.S. security. CFIUS has asked Rosneft and Morgan Stanley for more information about the deal, without approving or rejecting it, a step that lawyers said is not unusual for a transaction under review.

One Rosneft source said talks with CFIUS continued: "The U.S. bureaucracy has simply asked for more information. We are still in the game."

Others were less sure. A Western banking source who works with Rosneft said the company believes it could not do much with the assets of a U.S.-regulated bank - even if it was allowed to buy them - because of sanctions.

BORROWING FROM CHINA

In August, Rosneft applied for a $42 billion loan from a state wealth fund to help it weather sanctions. Last week, a Russian deputy prime minister said the government is considering the applications.

For now, Rosneft, which generates $30 billion in cash flow a year, is meeting its financing needs from internal resources. It can also borrow from China, which has made available billions of dollars of credit lines to Russia.

Morgan Stanley has been trying to sell its oil trading division for almost two years. Previous attempts to sell to buyers in the Middle East and Asia failed due to price and operational differences, according to market sources.

The failure to sell the unit may benefit the bank because revenue in commodity trading businesses has been rising this year as markets have gyrated.

Sources told Reuters in July that after more than a year of scaling back, Morgan Stanley has started expanding its commodity division again with plans to hire traders, sales staff and other professionals in the United States.

Copyright Reuters, 2014

By PLATTS

Five international oil companies and one local company to bid for a consultancy contract on a multi billion-dollar project, which will increase Kuwait’s oil and gas output

KOC

Hashim Sayed Hashim, CEO of Kuwait Oil Company, said, “Royal Dutch Shell, BP, Total SA, ExxonMobil and Chevron Corporation and Kuwait’s Al-Maraam Al-Ahlia have been pre-qualified for the contract. The project involves big technological challenges and we need help from international companies to implement the project.”

British Oil developer New World Oil and Gas is on track of growing its global portfolio following the purchase of a Kuwaiti company in a $1.38million deal.

The firm, which currently holds assets in Belize and Denmark, is set to own a 60% economic interest through 49% shares in Kuwait’s Al-Maraam Al-Ahlia following the signing of a sale purchase agreement with the company’s shareholders.

“

KOC said, in a statement, that it would issue a tender to the six firms to sign a five-year consultancy contract for the oil and gas projects starting 2015-2016.

Through this project, Kuwait’s oil output will be increased to 3.6mn bpd and gas production to 42.75mn cu/m per day by 2020.

The project consists of three parts including expansion of oilfields in the north and the south as well as development of heavy crude in northern fields in Kuwait, added Hashim.

The heavy crude project would cost around US$4.2bn. There was, however, no mention of investments involved in the other projects related to the north and south of Kuwait.