Lior Cohen

- Oil prices rallied in the past few days on account of strong U.S. data.

- Despite the high volatility in the oil market, the Brent-WTI spread remained relatively stable.

- What is next for the Brent-WTI spread?

The oil market has showed some signs of recovery as the price of WTI climbed back up to around $45 and Brent oil to $50. The concerns over China's growth, the supply glut and Iranian deal were gone out the window following the positive news from the U.S. regarding the higher than expected growth in GDP. Looking forward, will the spread remain at this low level close to $5?

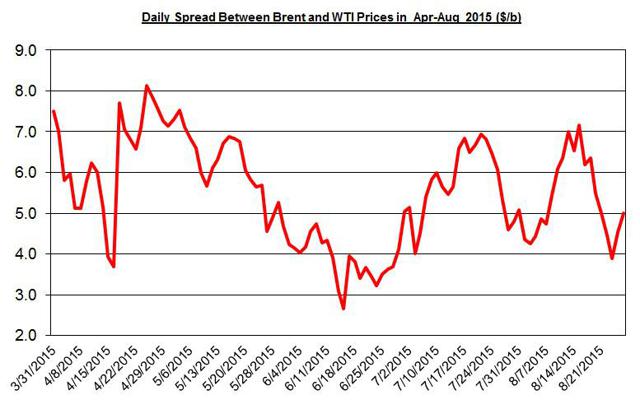

Despite the high volatility in oil prices in the past few months, the spread remained relatively stable between $3 and $7 for the most part. Margins of other oils such as Mars-Brent and LLS-Brent also moved in an unclear trend in recent months. The chart below presents the spread between Brent and WTI from April up to date.

Source: EIA

On an annual scale, the Energy Information Administration still expects the spread to remain, on average, at $5 in both 2015 and 2015. This outlook, however, is a slight downward revision from the May report - back then the 2015 average was $6. And in April the EIA expected the spread to reach an average of $7 this year. The slow decline in this year's outlook indicates the EIA expects the spread to modestly decline for the rest of the year, especially if you consider the annual spread, up to date, was $5.9 per barrel. The fall in the spread is more likely in the coming months considering the U.S. economic continues to tighten with growing demand for gasoline, on account of higher growth, and falling production - according to the latest EIA weekly report, U.S. output declined to 9.38, which is over 2% lower than in June 2015.

The ongoing slow descent in the spread in the Brent-WTI tends to have an adverse impact on the earnings of oil refineries in the U.S. such as Marathon Petroleum (NYSE:MPC) and Valero Energy (NYSE:VLO). Nonetheless, for Valero Energy, the improved gasoline and other products margins per barrel relative to Brent offset the narrower Brent-WTI spread. Moreover, the ongoing drop in oil prices could also behoove oil refineries.

Despite the latest rally in oil prices, they are still expected to remain low for a while. And the spread between Brent and WTI, while is likely to remain around the $4-$7 in the near term, could still, on average, slowly descent to around $4. In this case, oil refineries are likely to be adversely affected by this shift. But considering gasoline margins remain elevated and oil prices low, they aren't expected to suffer too much and keep showing high earnings.

Seeking Alpha