Recently published research from Business Monitor International, "Vietnam Oil & Gas Report Q2 2013", is now available at Fast Market Research

Oil output will rise in the short-term as new fields are brought online or are ramped up to peak production levels to offset declining volumes from the flagship Bach Ho field. We expect oil output to peak in 2016 but fall thereafter, as further growth could be hindered by exploration limits imposed by Vietnam's maritime dispute with China in the South China Sea. New developments are set to boost long-term gas production, while its downstream is finally picking up after years of delay in pushing forth new and much needed projects to meet the country's growing fuel demand.

The main trends and developments for Vietnam's oil and gas sector are:

Oil output will rise in the short term as new fields are brought online or are ramped up to peak production levels. This could push production up from an estimate of 335,370 barrels per day (b/d) in 2012 to 390,660b/d by 2016. However, this spell will end in 2017 unless further fields are developed. BMI therefore expects production to decline from its 2016 peak to 385,590b/d in 2017 and to 335,810b/d by 2022.

Economic growth - expected to average at 6.8% over our 10-year forecast period to 2022 - will continue to drive oil and gas consumption in Vietnam higher over the next decade. Our bullish economic forecast has led us to revise our oil consumption growth for Vietnam upwards; we see oil demand growing from 400,480b/d in 2013 to 586,630b/d in 2022.

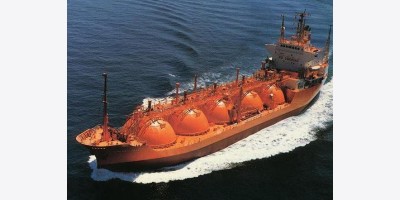

BMI estimates gas production will rise from an estimated 9.3bn cubic metres (bcm) in 2012 to 13.4bcm by 2017. Despite the increase, demand will outstrip supply from 2015, with up to 0.4bcm of net imports expected in that year. By 2022, net imports of gas could hit as much as 4.0bcm, all in the form of liquefied natural gas (LNG).

Oil and gas reserves could rise if new exploration gathers pace following the conclusion of the country's latest licensing round. However, ongoing risks from vigorous Chinese opposition to drilling in the disputed South China Sea could delay exploration. Therefore, for 2013 we have kept our oil reserves forecasts unchanged at 4.4bn barrels (bbl). However, Vietnam could still find it difficult to reverse a longer-term decline in reserves as production ramps up to meet rising domestic needs faster than discoveries are made to replace reserves. By end-2022, we expect proven oil reserves to have fallen to 4.2bn barrels (bbl). We expect gas reserves to remain flat at about 690bcm over our forecast period.

Vietnam's refining production is set for a rise from the construction of two newbuild refineries - Nghi Son and Vung Ro. Its refining capacity could increase from 140,000b/d in 2012 to 340,000b/d by 2017, rising further still to 500,700b/d by the end of our forecast period when these refineries fully enter operation. There is significant upside risk to this forecast, if four other proposed projects are brought into fruition.

Vietnam's refinery developments will preserve valuable light sweet domestic crudes for export, while allowing for the processing of cheaper heavier foreign grades for domestic consumption.

At the time of writing we assumed an OPEC basket oil price for 2013 of US$104.40 per barrel (bbl), falling to US$101/bbl in 2014. Global GDP in 2013 is forecast at 2.9%, up from an assumed 2.5% in 2012, reflecting some recovery in the US and China, though uncertainty with regard to the eurozone debt situation will continue to hamper growth. For 2014, growth is estimated at 3.4%.

Source: fastmr