OPEC oil output hits highest since October

OPEC oil supply has jumped in March to its highest since October as Iraq's exports rebounded after bad weather and Saudi Arabia pumped at close to record rates, a Reuters survey found, a sign key members are sticking to their effort to regain market share.

The increase from the Organization of the Petroleum Exporting Countries adds to excess supply in the market, despite some signs that the halving of crude prices since June 2014 is encouraging higher oil demand.

OPEC supply has risen in March to 30.63 million barrels per day (bpd) from a revised 30.07 million bpd in February, according to the survey based on shipping data and information from sources at oil companies, OPEC and consultants.

"Demand might be a bit stronger than expected at the beginning of the year, but I don't think it is strong enough to absorb the entire oversupply,'' said Carsten Fritsch, an analyst at Commerzbank in Frankfurt. "There's still oversupply in the market, which is reflected in the inventory builds.''

Besides Saudi Arabia, the main reasons for the rise are the resolution of involuntary outages—Iraq lifted exports due to improved weather and Libya managed to nudge production higher despite unrest.

If the total remains unrevised at 30.63 million bpd, March's supply would be OPEC's highest since 30.64 million bpd in October 2014, based on Reuters surveys.

Saudi Arabia was the driving force behind OPEC's refusal last year to prop up prices by cutting its output target of 30 million bpd, in a bid to discourage more costly rival supplies.

The group holds its next meeting in June, and comments from OPEC officials suggest it will not alter the policy.

In March, the largest increase has come from Iraq, whose southern oil exports recovered following bad weather that delayed tanker loadings, according to shipping data and industry sources. Northern exports were slightly lower.

Based on this survey, Iraq's exports have come close to December's record high of 2.94 million bpd, depending on whether tankers at the southern ports on earlier on Tuesday actually depart in March. Iraq was hoping to reach 3 million bpd of exports this month.

Saudi Arabia has increased output to within a whisker of 10 million bpd on average in March, sources in the survey said, due to higher demand from export customers and an increased local requirement in new oil refineries.

"The Saudis say they are responding to higher demand and I tend to believe that, looking at the strong refining margins in Singapore,'' said an oil consultant. Margins are well above the annual average in Asia, which buys the bulk of Saudi Arabia's exports.

Saudi Oil Minister Ali al-Naimi said on March 22 output was "around'' 10 million bpd. The highest known Saudi output is 10.05 million bpd in 2013, according to figures from the U.S. Energy Information Administration.

Of countries with lower output in March, the biggest decline was in Angola, partly due to a force majeure on exports on BP's Saturno crude stream. OPEC's other West African producer Nigeria also exported fewer cargoes in March.

Mexico Ready ‘Tomorrow’ If U.S. Approves Crude Swaps

(Bloomberg) -- Petroleos Mexicanos is negotiating with shale oil producers in Texas and North Dakota as it awaits a U.S. government ruling that could make it the second country approved for exports of unrefined crude.

Mexico’s state-owned oil company, known as Pemex, is ready to take deliveries of U.S. crude “as soon as tomorrow” if the U.S. Commerce Department approves an application for a crude exchange, Jose Manuel Carrera, chief executive officer of PMI, the firm’s commercial arm, said in a phone interview Monday.

Pemex asked the U.S. in January to allow it to swap heavy crude it produces in exchange for up to 100,000 barrels a day of U.S. light crude to increase Mexico’s gasoline production and improve refining. The U.S. bans most exports of unrefined crude oil, with an exception for shipments to Canada.

“We’re completely ready to start operating the swap,” Carrera said. “We’re very excited for this since it benefits both countries. We’d definitely want to see this happen as soon as possible.”

If the exchange is approved, Pemex would be able to continue selling its heavy oil directly to U.S. refineries, and purchase light U.S. oil from other companies, Carrera said.

Eugene Cottilli, a spokesman for the Commerce Department’s Bureau of Industry and Security, which is weighing the potential swap, didn’t immediately respond to phone and email requests for comment.

Pemex is negotiating with producers in the Eagle Ford and Permian regions in Texas and the Bakken region in North Dakota, Carrera said. It would import the U.S. crude at the Pajaritos and Dos Bocas terminals, which have enough capacity to handle the shipments.

The U.S. oil would be used at Pemex refineries in Salamanca, Tula and Salina Cruz, which have a combined capacity of 825,000 barrels a day, according to data compiled by Bloomberg. After decades of relying on domestic production, Mexico’s government approved energy reforms last year that allowed its refiners to import oil.

Storage Sells for 10 Cents a Month at U.S. Oil Import Hub

(Bloomberg) -- Oil cavern space at the Louisiana Offshore Oil Port sold for 10 cents a barrel a month at an auction on Tuesday, offering a glimpse into the value of storage as domestic crude supplies swell to a record.

The sale of more than 11 million barrels of room in a cavern at LOOP LLC’s Clovelly hub in Louisiana was part of CME Group Inc.’s plan to offer the first physically delivered futures contract for oil storage. CME, the largest commodity-trading platform, listed a contract for trading this week based on the space at LOOP.

Storage contracts are trading hands for the first time as U.S. crude stockpiles reached a record 466.7 million barrels and production continued to climb to the highest level in over three decades. Banks including Goldman Sachs Group Inc. are projecting another slide in oil prices as tanks in the U.S. near capacity and suppliers work to get rid of barrels.

“There was quite a bit of interest in it,” Terry Coleman, LOOP’s vice president for business development, said by phone Tuesday. “The beauty of it is there’s full transparency for all participants.”

U.S. benchmark West Texas Intermediate oil for May delivery at the Cushing, Oklahoma, storage hub fell 2.2 percent to settle at $47.60 a barrel Tuesday on the New York Mercantile Exchange. Futures have fallen 56 percent since settling at $107.26 on June 20.

NEO Markets Inc., which ran the sale of LOOP’s storage on Tuesday, will continue to auction 7,000 contracts a month, each entitling the holder to 1,000 barrels of storage space at a storage cavern in Clovelly.

Clovelly Hub

Chris Grams, a spokesman for Chicago-based CME, said the storage futures contract cleared a U.S. Commodity Futures Trading Commission review and became available on the New York Mercantile Exchange for Monday’s trade date. At expiration, the holder keeps the right to physically store sour crude at the Clovelly hub for the month specified.

NEO auctioned 875 May storage futures contracts, which will be cleared by CME, for 10 cents a barrel. In addition, it auctioned 10,409 physical forward agreements for specific months over the next year at prices between 5 and 8 cents a barrel. Another auction will take place next week, Coleman said.

The storage futures are expected to improve the liquidity of CME’s existing Gulf Coast sour crude futures contract, which is physically deliverable at LOOP, CME said in a March 4 statement. The exchange planned to broaden the specifications of its sour crude contract to include Poseidon, Mars and LOOP Seg 17 grades in the Gulf.

Storage Tanks

LOOP, the largest crude-import hub in the U.S., has about 69 million barrels of capacity in storage tanks and underground caverns.

Spot Mars Blend oil loaded at Clovelly fell 40 cents to a $2.95-a-barrel premium versus WTI on Tuesday, data compiled by Bloomberg show. Poseidon crude, loaded at Houma, Louisiana, fell 55 cents to $2 a barrel over WTI.

Mars for June delivery sold for 29 cents a barrel more than Mars for May delivery on Tuesday, according to data compiled by Bloomberg.

A more liquid Gulf Coast sour crude contract could compete against benchmarks such as the Argus Sour Crude Index, which is used as the basis for U.S. sales of crude from Saudi Arabia and Iraq. The Argus index and other Gulf sour benchmarks are based on private trades voluntarily reported to the companies, rather than trades executed on a visible platform.

Libyan oil guards demand state firm to reopen the two biggest oil ports

TRIPOLI/BENGHAZI, 13 hours, 41 minutes ago

A Libyan state oil security force has called on state oil firm NOC to reopen the Ras Lanuf and Es Sider oil ports, the country's two biggest, after a rival force pulled out from the area following months of fighting, a spokesman said.

An oil official said earlier it was too soon to say when the two terminals, which have a combined capacity of 600,000 barrels a day, could resume work.

A force loyal to a self-declared Tripoli government withdrew troops from near the ports, which it had been trying to seize since December, another official said. The ports halted work then.

"The oil ports are safe," said Ali al-Hassi, spokesman for a force guarding the ports on behalf of the official government based in the east. "We call on NOC to lift force majeure from the ports so the oil companies can resume work."

NOC had declared the contractual waiver in December.

But the oil official said security and technical checks needed to be conducted first. "We need to check whether pipelines and storage are undamaged," he said, asking not to be identified. Storage tanks at Es Sider were hit by a rocket in late December, burning for a week, as fighting raged.

The region south of the ports is home to several oilfields that were attacked in recent weeks by fighters loyal to the militant group Islamic State.

The militants are exploiting a security vacuum, just as they did in Syria and Iraq, created by a struggle between two governments vying for control four years after the ousting of leader Muammar Gaddafi.

The North African country's official government has been confined to the east since a rival group seized Tripoli in August, setting up its own administration.

The Tripoli force had moved out from camps west of Es Sider to tackle a growing threat from Islamic State in Sirte, a central city.

Libya has boosted oil output in recent weeks despite turmoil gripping much of the country. Production hit 564,000 barrels per day and is expected to rise further, a spokesman for National Oil Corp (NOC) said.

But NOC had to declare force majeure this month at 11 oilfields in the Sirte basin south of Es Sider after Islamic State attacked at least three facilities and kidnapped up to 10 foreign oil workers.

--Reuter

More Iran oil post-sanctions, aimed at Asia, may hurt Iraq

DUBAI, 13 hours, 44 minutes ago

A possible surge in Iranian oil exports from an end to sanctions will reboot a struggle between top Middle East producers for Asian buyers, with Iraq looking the most vulnerable.

The latest twist to the saga of aggressive marketing is the world oil glut and low prices, likely to fall more with added Iranian crude, making Tehran's battle for market share tougher.

"You cannot produce without demand. There is a limit in any market and also long-term contracts between Gulf oil producers and Asian refiners," said a Gulf oil source.

"That's why it is hard to imagine big volumes just eating into the market share just like that. Even if the Iranians offered discounts and sold on the spot market, there is a limit."

Under sanctions Iran became adept at offering discounts, easy credit and free shipping to keep in the game, recalling Iraq's tactics to re-enter the market after the fall of Saddam Hussein. Baghdad's position remains arguably more tenuous than the established might of top oil exporter Saudi Arabia.

State oil giant Saudi Aramco has also been slashing its prices for its crude to Asia. Fellow Opec members Iraq and Kuwait have followed suit.

"Everyone is after market share," said an Iraqi oil source.

"Iraq is the one who is disadvantaged as it is trying to place new volumes and take new market share.

If Iran would start to return it is almost inevitable that there would be some form of price war between them," said Samuel Ciszuk, senior adviser on security of supply to the Swedish Energy Agency.

"You want to have the bulk of reliance by suppliers that are seen as much more stable," he added. "The Gulf states have a natural edge in that, they would not have to sell their crudes at a discount like the Iraqis or the Iranians."

International negotiators are still working out details of the deal on Iran's nuclear programme, but it would almost certainly lift sanctions only in stages, deferring even a partial return of Iranian crude exports until at least 2016.

Sanctions have halved Iran's oil exports to just 1 million barrels per day (mbpd) from 2.5 mbpd in 2012.

Sources familiar with Iranian oil policy say other Opec members have benefited by taking more market share when Tehran's crude exports fell and expect them to make room for Iran, when sanctions against it end.

CHINA AND INDIA

Big Asian refiners, some with plants used to dealing with Iranian oil grades, see themselves buying more from Tehran if sanctions hurdles are removed. They remain customers but the scale of their purchases has been limited by logistical, insurance and diplomatic factors linked to sanctions.

China is the main buyer of both Iraqi and Iranian crude."If they reach a consensus on the nuclear issue... and the US, the West relax controls on Iran’s oil sales, I believe China’s crude imports from Iran will increase," Wang Dongjin, vice chairman and president of PetroChina, said.

"If that happens, it will provide more bargaining power to China in terms of importing oil from the entire Middle East," he said.

However, with Chinese demand growth slowing and its storage tanks near full, the room for a sharp increase in Iranian supplies is limited.

The Petrochina boss said he expected crude imports from Iran this year to stay "roughly the same" as in 2014. Iranian oil exports to China has been near pre-sanction levels at around 550,000 bpd since last year.

Earlier this month, Iran's oil minister said Tehran was ready to increase oil exports by up to 1 mbpd when sanctions are lifted.

But market experts and Gulf Opec sources estimate an increase in production ranging from 200,000 - 600,000 bpd within six months after a conditional and gradual lifting of economic sanctions, and do not see a full return of Iranian crude until the second half of 2016.

Iran already has more than 20 million barrels in floating storage ready to be sold and has leased crude storage facilities in Asia.

India's state refiner Hindustan Petroleum Corp has said it can replace some Iraqi oil it buys through France's Total, with Iranian crude if terms offered are better.

"I will definitely consider Iranian oil based on economics. If current terms and conditions are retained then we may buy,” said B K Namdeo, head of refining at HPCL.

Vijay Joshi, head of refinery operations at India's Mangalore Refinery and Petrochemicals Ltd (MRPL) said: "We would like to lift more and more heavy crude from Iran as that suits my refinery configuration." --Reuters

Pumping resumed in Iraqi oil pipeline to Ceyhan

Crude flow in the Iraqi pipeline carrying Kirkuk and Kurdish oil to Turkey's Mediterranean port of Ceyhan resumed after a technical problem was fixed, an official at Turkish state pipeline operator Botas told Reuters.

The pipeline was pumping around 425,000 barrels per day (bpd) before it was halted.--Reuters

India skips Iran oil imports in March under US pressure

NEW DELHI, 13 hours, 51 minutes ago

India halted oil imports from Iran for the first time in at least a decade in March as New Delhi responded to US pressure to keep its shipments from Tehran within sanction limits during the last month of negotiations on a preliminary nuclear deal.

Iran and six world powers have ramped up the pace of negotiations this week ahead of the Tuesday deadline for reaching an initial accord on a final nuclear agreement. Both sides have warned it was crucial to overcome differences that could still wreck any chance at a deal.

India is Iran's second-biggest buyer on an annual basis after China, yet it did not take any crude from Tehran in March, according to tanker arrival data from trade sources and ship tracking services on the Thomson Reuters terminal.

Refinery sources said this was the first time in at least a decade that no imports were made over the space of a month - indicating how Washington is trying to maximise economic pressure on

Tehran amid the talks aimed at stopping Iran from gaining the capacity to develop a nuclear bomb.

"There is pressure from the US on all Asian buyers to stick to the sanctions regime," said Johannes Benigni, chairman of JBC Energy in Vienna.

The halt in March comes after February imports hit a 1-1/2-year low for monthly imports, which together brought India's annual crude and condensate purchases from Iran in the year to March 31 to an average 220,000 barrels per day (bpd) or 11 million tonnes, slightly below shipments in the previous year.

Days ahead of a visit by US President Barack Obama to India in January, the oil ministry had told Essar Oil, Mangalore Refinery and Petrochemicals Ltd and Indian Oil Corp - the Indian refiners that buy from Iran - to cut their imports over February and March to keep the fiscal-year figure in line with sanctions limits.

Refiners in India had raised imports during the April-December period by more than 40 per cent, leading US authorities to raise the alarm with India's foreign ministry ahead of Obama's visit.

The sanctions currently restrict Iran's overall exports to 1 million-1.1 million bpd (mbpd), with Asian buyers required to keep their purchases near end-2013 levels.

In February, imports by Iran's four biggest buyers - China, India, Japan and South Korea - though down on-year, bounced back to average 1.02 mbpd, a two-month high, government and tanker-tracking data showed.

JUMP IN APRIL IMPORTS EXPECTED

Despite India's import halt in March, shipments are expected to resume next month, with at least MRPL and Essar loading Iranian oil, trade sources said.

India's oil imports from Iran could sharply rise if sanctions are lifted and the Islamic nation continues to give oil on current terms, company officials said.

National Iranian Oil Co (NIOC) officials told Indian refiners it would continue to offer crude on 90-day credit terms and at a discount to the official selling price if sanctions were lifted, two sources said, although NIOC executives indicated Iran may stop offering free shipping.

"I will definitely consider Iranian oil based on economics. If current terms and conditions are retained, then we may buy," said B K Namdeo, head of refining at Hindustan Petroleum Corp Ltd (HPCL).

HPCL has not received any Iranian crude since May 2013, after first halting its purchases from Iran in 2012 because insurance companies under pressure from Western sanctions had stopped covering installations processing Iranian oil.

MRPL, which has continued to buy Iranian crude, said it would import more oil from Tehran if sanctions are lifted.

"Subject to approval by the oil ministry ... we will increase the supply," said Vijay Joshi, head of refinery operations at MRPL. --Reuters

Iran’s return to oil market will be ‘long and arduous’

By Myra P. Saefong

SAN FRANCISCO (MarketWatch)—Everyone seems to think that an agreement to limit Iran’s nuclear program and ease sanctions on the country would suddenly add lots of oil to the world market, but some analysts say it won’t.

It is easy to see where the idea came from. After all, Iran does hold the world’s fourth-largest proven crude-oil reserves, according to the U.S. Energy Information Administration.

But if Western powers reach a pact with Iran over its nuclear program, it might not make much of an immediate difference to the oil market. Iran would need time to improve its ailing oil infrastructure, so it wouldn’t dump a bunch of oil CLK5, -0.61% LCOK5, -0.20% into the world market all at once. Also, a final agreement isn’t due until the end of June.

A view of a petrochemical complex in Assaluyeh seaport on Iran's Persian Gulf coast.

The deadline for an agreement is “like one of those deadlines that isn’t really a deadline—like a line in the sand that tends to get moved with the wind of the desert,” said Kevin Kerr, president of Kerr Trading International.

The talks appear set to continue into Wednesday, The Wall Street Journal reported, extending a key, preliminary deadline that had been set for Tuesday night.

If all sanctions on Iran were lifted, the country could dump another 800,000 barrels a day on the market, Kerr said. But it’s “highly unlikely that will happen” because Iran’s oil infrastructure has suffered from years of sanctions, he said.

Still, Iran apparently has lots of oil in floating storage.

John Macaluso, research analyst at Tyche Capital Advisors, said the “most immediate impact of a deal would be the release of at least 30 million barrels of Iranian floating storage on a fleet of supertankers hitting a crowded, oversupplied market once Western sanctions are lifted.”

That’s “a lot of oil to hit the market,” he said, adding that he would expect to see lower prices.

Matt Schneider, a commodity analyst at Schneider Electric, said he believes Iran will attempt to increase its production as much as possible as soon as oil sanctions are lifted, regardless of market price, as it needs to “kick-start revenues once more.”

But “the challenges faced due to having to restart older fields mean the return of flows will be a long and arduous process,” he said.

Kingdom unfazed by oil price slump

Saudi Arabia is keenly watching the oil scene. As the fluctuating oil prices show signs of decline, countries are debating how low they can go and whether such a scenario is beneficial in the long run. The Kingdom, however, remains least impacted by the declining oil price and is confident that it will rise and stabilize sooner than expected.

Economists believe cheaper oil is and will benefit emerging Asian economies. Although they can gloat over the immediate favorable impact, like paying less for their oil imports, there is an ongoing debate about the benefits or otherwise of the declining oil price.

The price of oil is currently around $55 a barrel, having dropped by more than half of what it was last June — $115.

On last Thursday, oil jumped 5 percent on fears that the conflict in Yemen could disrupt cargoes on the neighboring Bab El-Mandeb Strait, where 3.8 million bpd of crude and oil products flow.

However, oil tumbled 5 percent on Friday, erasing the previous session's gains, as Yemen's conflict looked less likely to disrupt Middle East crude shipments.

The current oil price volatility underscores the urgency of re-engineering the fiscal systems of the GCC countries. Traditionally, oil price volatility has been handled by amassing reserves for the proverbial rainy day. However, the rapid growth in government expenditure, partly as a result of population growth, partly due to the investments needed to diversify the economies, is making this an increasingly difficult balance to manage. Problematically, not even the most diversified regional economies have been particularly successful in linking government revenues to nonoil sector dynamics.

From a global standpoint, savings in energy expenditures for oil importers are effectively wealth transfers from oil exporters from the lower oil prices; GCC would be subsidizing growth in Asia at the cost of reducing its export revenues.

According to Asiya Investment, fiscal positions for GCC countries are being significantly affected from the oil price slide due to their strong dependence on oil export revenues.

One of the costliest systems operated by the Gulf states is the generous regime of energy and other subsidies. This involves not only a fiscal cost, it also has broader economic implications as companies reliant on subsidized prices have less of an incentive to seek productivity gains and innovate. This in turn has adverse growth implications. Similarly, subsidies are a very inefficient way of achieving social policy objectives as they do not differentiate among people or companies.

Email: khalil@arabnews.com

Nigeria’s oil revenue drops to $32.3b, says IMF

By Roseline Okere

Revenue received by the federation from crude oil sales, Petroleum Products Taxes (PPT), and royalties (after subsidies provided by Nigerian National Petroleum Corporation (NNPC) and cash calls) has decreased from $45 billion in 2011 to $32.3 billion in 2014, according to International Monetary Fund (IMF) Country Report on Nigeria.

Besides, between 2011 and 2014, oil lifting fell from 2.38 to 2.19 mbpd (71⁄2 per cent decline), largely due to stoppages associated with pipeline vandalism. The report, which was released on Monday, stated that the drop in oil revenue over 2011 to 2014, was larger than expected from the evolution of oil prices and production.

The IMF said that in 2015, oil exports are projected to decline by six percentage points (ppts) of Gross Domestic Product and oil revenue by 2.4 ppts of GDP from 2014 levels, with a reduction in the current account balance and loss in international reserves.

IMF noted that a sharp contraction in public investment and domestic demand is projected to reduce growth to 4¾ percent, with inflation increasing to 11½ percent from the effects of exchange rate depreciation.

It stated that these developments also increase risks to the banking sector, given its significant exposure to the oil industry and the potential for capital outflows. “The outlook is subject to significant risks, both external (changes in oil market developments and investor sentiment) and domestic (uncertainty from the election outcome and security situation). Managing adjustment.

“

The IMF said that as the oil price fall appears more permanent than temporary, additional policies will be needed, including greater flexibility in the exchange rate and further fiscal adjustment, particularly in state and local governments.

It noted that it will be essential to ensure that fiscal adjustment is achieved without endangering the delivery of critical public services. Boosting inclusive growth. “The authorities have a comprehensive economic transformation agenda, designed to boost growth, create new job opportunities, and reduce poverty.

With recent oil market developments, however, non-oil revenue mobilization (including an increase in VAT rate) is more urgent than ever and is critical for creating the fiscal space necessary to implement the transformation agenda. Further, the national infrastructure investment plan needs careful prioritization, as financing the entire plan would be a challenge, even with more supportive financial conditions and good progress in financial inclusion”.

IMF stated that a share of the market value of lifting, revenue from PPT and royalties—related to oil lifting other than the NNPC JV allocation declined from about 42 percent in 2011 to 36.9 percent in 2014. This decline, it noted, reflects higher capital and operational costs, part of which can be attributed to vandalism and production disruptions. “These factors reduced the oil revenue yield by 3.6 percentage points (estimated as a residual), equivalent to a loss of about 0.5 percent of GDP in oil revenue in 2014”.

It said that over this period, oil prices also declined by 61⁄2 per cent (from $109 to $102 per barrel). “The direct impact of these two factors reduced revenue by about $5.5 billion in 2014 relative to 2011. The observed drop in revenue was much larger (about $12.5 billion), implying a fiscal yield (relative to the market price)—the ratio of oil revenue to the market value of oil lifting—that declined from 47.2 percent to 39.5 percent over 2011 to 2014”. It disclosed that the recent fall in prices has compounded a secular decline in investment and production of oil, and highlighted the vulnerability of fiscal revenue and foreign exchange to high oil-dependency.

© Copyright Guardian NewsPapers | About us | Contact us | Advertise | Designed and Managed by ANOZIM

Mexico eyes 4.3 percent in 2016 spending cuts as oil slump bites

MEXICO CITY (Reuters) - Mexico's Finance Ministry on Tuesday said it expects to cut spending next year by 4.3 percent as revenue slumps because of a plunge in oil prices and flagging crude production.

The government plans to trim the 2016 budget by 135 billion pesos ($8.9 billion) from the spending level planned in 2015, according to a statement from the ministry.

The cuts follow a previously announced reduction in spending plans for 2015 that have crimped the growth outlook in Latin America's second-largest economy as the government dials back on planned infrastructure projects.

The government cut 2015 spending in late January by nearly 3 percent, or 0.7 percent of gross domestic product, after a sharp drop in oil prices. The government relies on oil sales to fund about one-third of its budget.

The ministry estimated an average price in 2016 for Mexican crude of $55 per barrel, more than 25 percent below the price it has hedged its expected oil export income for 2015.

Global oil prices have slumped about 60 percent in the last nine months which has damped expectations that Mexico will quickly see a flood of investment into its energy sector after it opened up the oil and gas industry to private capital.

Mexican oil output has fallen to its lowest in decades. The latest forecasts projected production in Mexico, a top exporter to the United States, would come in at 2.288 million barrels per day (bpd) this year.

The government had projected that oil output would be at 2.4 million bpd this year, but output from state run company Pemex in the first three months of the year has been less than 2.3 million bpd.

The government projected crude output would climb back to 2.4 million bpd in 2016, but that estimate was down from a previous forecast of 2.5 million bpd in 2016.

Mexican gross domestic product growth is expected to come in at a range of 3.3-4.3 percent in 2016 after a predicted range of 3.2-4.2 percent in 2015, the Finance Ministry projections showed.

The economy expanded 2.1 percent last year.

The government also said it was committed to trimming its budget deficit, anticipating that the net public sector borrowing requirements would drop from 4 percent of GDP this year to 3.5 percent of GDP in 2016.

($1 = 15.2628 Mexican pesos)

(Reporting by Michael O'Boyle; Editing by Alan Crosby, Bernard Orr)

© Thomson Reuters 2015 All rights reserved.

Gazprom Feeling The Heat From Sanctions And Low Energy Prices

By Nick Cunningham

Posted on Tue, 31 March 2015 21:37 | 0

Cracks are widening in Russia’s flagship natural gas producer Gazprom.

The state-owned gas company has suffered mightily under the weight of western sanctions and the fall in energy prices. And the results are beginning to show. Gazprom announced that its net income plummeted by 70 percent in 2014, which will result in a cut in its dividend.

Those numbers represent the cumulative blow from a bad year for Gazprom in 2014. The company’s troubles went beyond low oil prices and sanctions. Due in part to the conflict in Ukraine, Europe has shown renewed resolve to break Russia’s energy grip, with a few recent successes. Lithuania has brought a new floating LNG import terminal online in 2014, providing a major alternative to Russian gas. Poland expects to do something similar this year.

Nevertheless, the seeds of legal action that is currently bearing fruit (from the European Union’s perspective) were planted in 2011 with the passage of the EU’s Third Energy Package. According to Judy Dempsey at the Carnegie Endowment for International Peace, EU antitrust regulators have demonstrated an impressive willingness to take a hardline with Gazprom over market access, with the intention of breaking up Gazprom’s monopoly.

The antitrust regulators, Dempsey says, can be credited with forcing Russia to backtrack on the proposed South Stream pipeline, a project that Russia had hoped would allow it to bypass Ukraine and send natural gas beneath the Black Sea to Bulgaria. Once the EU threatened Bulgaria with penalties if it followed through on the project, Gazprom backed off. The project is now suspended and Russia has shifted its sites to Turkey.

Regulators are also responsible for scaring Gazprom away from expanding connections to the Nord Stream pipeline, a project that runs from Russia to Germany via the Baltic Sea.

The EU can claim those unofficial victories, but a much larger antitrust case is mounting in Brussels. The EU may charge Gazprom with violating antitrust laws and manipulating prices, which could result in billions of dollars in fines and pressure Gazprom into giving up its practice of linking natural gas prices to the price of oil in long-term contracts. That has been the principle point of contention for years. Now that oil prices have collapsed (and natural gas prices along with them), Gazprom is ironically hurting from the approach that it has fought so hard to defend.

Could this be the reason for Saudi Arabia's stance on oil supplies?

There's an incredible energy development we've been keeping track of for you over the past year... It's the reason Saudi Arabia is acting in desperation... depressing oil prices... and even risking internal unrest. Their (and OPEC’s) very survival is being threatened.

And we believe we’ve put together an incredible video revealing how it works.

Taken all together – the collapse in oil and gas prices, western sanctions cutting off credit, improved access to energy for the EU, and a looming antitrust battle – Gazprom is ailing. The 70 percent fall in profits attests to that fact.

In early March, Gazprom even had to go running to the Russian government for aid, to which it asked for $3.3 billion in assistance. Without access to western finance, Gazprom has struggled to raise cash.

All is not lost. Gazprom is seeking customers outside of Europe, where it has historically sold most of its gas. On March 17 Gazprom announced that it had signed a deal with Egypt to send it 35 cargoes of LNG, which will take place over five years. That agreement added to the momentum between Russian and Egyptian relations. Russian President Vladimir Putin is pushing to expand trade between the two countries, and crucially, use local currencies rather than dollars to do it. Goldman Sachs upgraded its credit rating for Gazprom on March 29.

But the megadeals that Russia has signed with China will go a long way to determining Gazprom’s growth prospects. Russia plans on exporting gas to western China. It also hopes to export Siberian gas through a future pipeline to China’s east, although the certainty over the timeine of that project is up in the air as Russia focuses on the more feasible western project.

And it is not as if Gazprom has given up on Europe just yet. The Russian gas giant says that despite efforts on behalf of the United States to send LNG to Europe in order to undermine Russian influence, it can sell gas to Europe at a better price than American LNG. But even if that is the case, it will likely have to give up oil-indexed pricing and make large concessions to the EU. Times are not quite as good as they used to be for Gazprom.

By Nick Cunningham of Oilprice.com

A World Remade by Fracking

With storage tanks full, panickers have no place to hoard oil in response to Middle East fears.

By Holman W. Jenkins, Jr.

If not for fracking, oil would probably be $200 a barrel and gasoline $6.50 in the U.S.

Western economies would likely be in free fall. The grudging U.S. recovery would be in retreat. The modest and possibly illusory green shoots seen in Europe, largely a function of cheap oil and a strong dollar, would wither. Japan would be even more of a write-off than it already is.

Russia would be even more emboldened in its geopolitical predations. Vladimir Putin would be raking in vaster bucks, rather than vastly diminished bucks, for his oil. Europe and the U.S., feeling broke and bedraggled, would be even less eager for confrontation.

Speculating about counterfactuals can be a foolish exercise, but oil traders usually take fright at geopolitical upsets that threaten supplies out of the Middle East. Yemen sits at the narrow Bab el-Mandeb chokepoint through which 3.8 million barrels a day flow from Saudi Arabia’s Red Sea terminals and elsewhere to the world. Yemen’s upheaval comes at the hands of Houthi tribalists backed by Iran, whose military already threatens another key Mideast oil chokepoint, at the exit of the Persian Gulf.

To register panic about all this and drive up prices, however, oil buyers have to be able to hoard oil. That’s becoming all but impossible. A huge amount of surplus production is already sloshing around the world, mostly as a result of U.S. fracking. As a consequence, storage tanks are full to overflowing. Panickers and speculators may well be physically unable to drive up prices significantly if they wanted to.

Even with the world increasingly clear-eyed about the consequences of the fracking revolution, if not the unprecedentedly sharp episodic growth in U.S. output last year, oil still topped $100 a barrel as recently as eight months ago.

To belabor what was once obvious, instability in the Middle East typically has been bullish for oil prices, as witnessed by various Arab-Israeli wars and Iraq’s wars with its neighbors. Saudi jets have already entered the fight to stop Iran’s allies in Yemen. If necessary, Saudi troops will likely intervene on the ground, waging a fight that would also be a fight for the interests of global oil consumers.

A direct confrontation between Iran and Saudi Arabia over Yemen could be shaping up. Iran is on the march in Iraq and Syria. Much of the Middle East is in chaos. That all this could be happening and yet oil pundits are more concerned about oil dropping to $20 a barrel, because of a lack of storage to accommodate our abundance, testifies to a geopolitical somersault the world is still trying to make sense of.

Fracking overnight has relieved Saudi Arabia of its swing-producer dominance. Fracking overnight has relegated the Middle East to a sideshow, albeit a still-important sideshow, in the world economy.

Things change fast and could change back. A sizable share of the world’s oil still flows from the Persian Gulf and so far production has not been disrupted. Prices would shoot up—they’re already creeping up. But a weight on U.S. fracking would also be lifted. At prices below $50, much fracking becomes long-term unprofitable. But then there’s the flip-side: the flexibility exhibited by the U.S. wildcat sector, allowing drilling to ramp up quickly in response to higher prices, helping to counteract any damage to global growth.

Naturally we come to the potentially least important piece of today’s mélange: the Obama administration’s negotiations over Iran’s nuclear program.

In its saner moments, the administration allows that the U.S. cannot secure Iranian sanctions for the long run unless it’s also prepared to negotiate over the concerns that led to sanctions being imposed in the first place. Iran wants sanctions lifted and doesn’t intend to abandon its pursuit of nuclear capability. Banish any other thought from your head. Not only are potent swaths of the Iranian elite getting rich directly and indirectly off the nuclear program. The regime would likely fatally discredit itself if it now disavowed a nuclear quest for which it has inflicted so much suffering and penury on the Iranian people.

Not going to happen. So unless the purpose is simply to let Team Obama get out of town without Iran calling its bluff on Iran’s nuclear effort, a useful deal would be one that legitimizes the continuation of sanctions, despite the clamor of the Europeans, Russians and Chinese to resume business with Tehran, once it becomes clear the Iranians aren’t going to deliver.

Such a deal could make sense, but from Israel and Saudi Arabia you hear a different fear. By design or by default, the deal being negotiated would end up formalizing a U.S. tendency to cede its Mideast power broker role to Iran. Why? Because, thanks to fracking, the U.S. just doesn’t care that much about the Middle East anymore.

Battered Oil Shows Signs of Life

Expected slowdown in U.S. production should support prices

By Nicole Friedman

Oil bulls are back in the fight.

The expansion in U.S. oil production, a major driver behind crude’s nine-month slide, is close to slowing, some investors and analysts say. That could spark a turnaround in prices that had tumbled as much as 59% since last June.

Signs of a slowdown in the pace of U.S. crude-oil output could come as soon as April. The Energy Information Administration, which collects and analyzes energy data for the U.S. government, in March predicted April’s production would decline month over month in three shale-oil-producing regions.

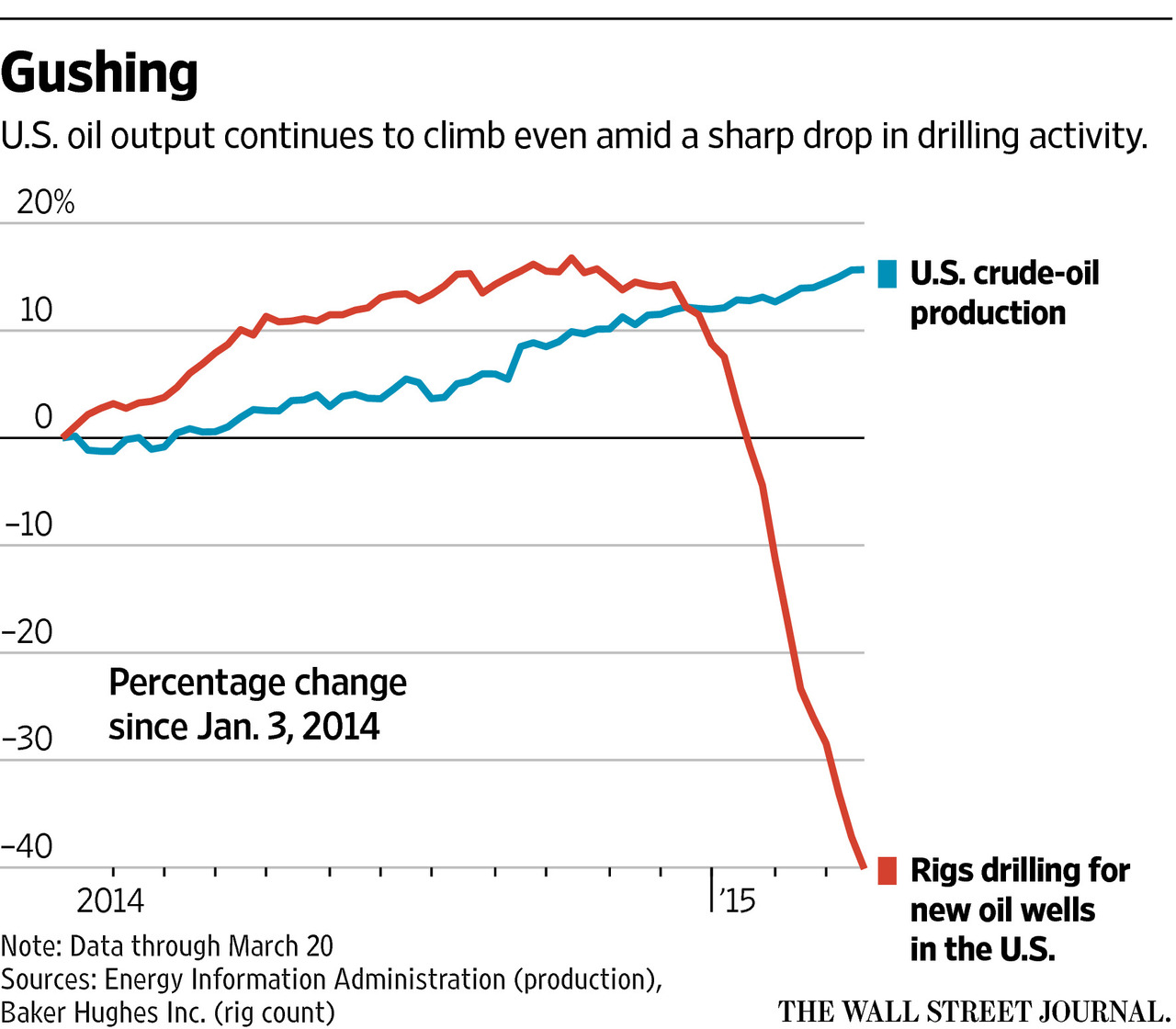

Although total output in the seven main U.S. shale-oil-producing regions is expected to rise in April, the EIA forecasts the smallest month-over-month gain since January 2011. If realized, such a slowdown would follow a steady drop in the number of rigs drilling for oil in the U.S. The number of rigs drilling for oil in the U.S. has plunged more than 40% since the start of the year.

But few investors are confident enough to call an oil-price bottom. Global demand for crude is likely to be tepid in April as refineries from the Middle East to Asia idle units to perform seasonal repairs, potentially forcing more oil into already brimming storage tanks. The amount of oil in the closely watched Cushing, Okla., storage hub is nearing maximum capacity. Cushing, the delivery point for futures traded on the New York Mercantile Exchange, was 80% full as of March 20, according to the EIA.

U.S. crude-oil stockpiles stand at their highest level in about 80 years, the EIA says. If storage continues filling up, that could spur another leg down for crude, as the number of buyers will dwindle because they will be strapped for space to stash the oil.

In the shorter term, “the market is hyperfocused on [U.S.] inventories filling up,” said David Zusman, chief investment officer at Talara Capital Management, which oversees about $400 million. “But the bigger story is the decline in rig count…and the likely decline in the rate of change in production that should be evident by the end of the summer.”

Talara has been adding exposure to energy stocks and bonds, Mr. Zusman said.

Benchmark U.S. crude-oil prices slid 10.6% in the first quarter, settling at $47.60 a barrel Tuesday on the New York Mercantile Exchange. Brent, the global benchmark, settled Tuesday at $55.11 a barrel on ICE Futures Europe, putting its quarterly decline at 3.9%.

After losing half their value in 2014, oil prices somewhat stabilized in the first quarter due to winter demand for heating fuels and signs that oil companies were drilling less in response to low prices. But prices resumed their fall in March as traders focused on record crude supplies in the U.S. and ever-growing production.

U.S. refineries are expected to process more crude in the second quarter as they complete seasonal maintenance, and a busy period of summer driving should help keep a lid on stockpiles. U.S. refineries processed roughly 15.5 million barrels of crude oil daily in the first quarter, according to the EIA, compared with a five-year average of 14.5 million barrels a day for that quarter.

But global demand may not bounce back because maintenance season for some plants outside the U.S. lasts well into the spring. London consulting firm Energy Aspects expects global refineries to process 76.8 million barrels a day of crude oil in the second quarter, down from 77.1 million barrels a day in the first quarter.

“

Write to Nicole Friedman at nicole.friedman@wsj.com

Oil Prices Slide on Expectations of Iran Deal

More Sharing ServicesShare | Share on print Share on facebook Share on twitter Share on email Subscribe

Oil prices fell Tuesday as a deal on Iran's nuclear program appeared more likely, raising the chances of increased Iranian crude-oil exports.

Tuesday was the deadline for Iran and six other nations to outline the main elements of a deal constraining Iran's nuclear program in exchange for lifting international sanctions. The U.S. State Department said the parties made enough progress to merit staying at the talks until Wednesday. The deadline for a final agreement is the end of June.

Iran, which has 10% of the world's crude-oil reserves, has seen its production and export capacity sharply curtailed by sanctions. Its crude exports dropped from 2.5 million barrels a day in 2011 to 1.1 million barrels a day in 2013, according to the U.S. Energy Information Administration.

Market watchers say additional oil supplies from Iran would flood an already-oversupplied market and push prices even lower. Oil prices have dropped more than 50% from their mid-June high due to growing production and lackluster demand.

"Negotiations are moving forward--a deal is going to happen," said Bill O'Grady, chief market strategist at Confluence Investment Management, which oversees $3.2 billion. "These are barrels...have to be accounted for. They may not be coming today or the next day, but they will be coming."

Light, sweet crude for May delivery settled down $1.08, or 2.2%, at $47.60 a barrel on the New York Mercantile Exchange. Prices fell 4.3% on the month and 11% in the quarter.

Brent, the global benchmark, slid $1.18, or 2.1%, to $55.11 a barrel on ICE Futures Europe. Prices posted a 12% monthly loss and 3.9% quarterly loss.

Both benchmarks fell for the third straight quarter.

But some analysts caution that even if a deal on Iran's sanctions is reached, the impact on oil markets won't be immediate, and it is uncertain how quickly Iran can ramp up production.

"They're extending the talks, potentially to tomorrow, but that's only to reach an outline," said John Saucer, vice president of research and analysis at energy-advisory firm Mobius Risk Group. "We're not seeing any imminent change in policy vis a vis the Iranian sanctions, and not seeing any imminent change in Iranian supplies."

Traders are also waiting for weekly inventory data on Wednesday, which is expected to show that U.S. crude-oil inventories hit a record high last week. Stockpiles are at their highest in about 80 years, as production continues to grow and demand has been muted due to seasonal refinery maintenance.

Analysts surveyed by The Wall Street Journal expect the EIA to report that crude stockpiles rose by 4.6 million barrels in the week ended March 27, while gasoline supplies fell by 900,000 barrels and stocks of distillates, including heating oil and diesel fuel, declined by 300,000 barrels.

The American Petroleum Institute, an industry group, said late Tuesday that its own data for the same week showed that crude inventories rose by 5.2 million barrels in the week, gasoline supplies fell by 4.1 million barrels and distillate stocks rose by 18,000 barrels, according to market participants.

Gasoline futures fell 2.06 cents, or 1.1%, to $1.78 a gallon. Prices rose 0.7% this month and gained 24% this quarter.

Diesel futures fell 1.33 cents, or 0.8%, to $1.7179 a gallon, posting a 25% monthly decline and 7% quarterly loss.

Laurence Norman contributed to this article.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

03-31-150605ET

Copyright (c) 2015 Dow Jones & Company, Inc.

Crude Oil Ends Lower On Iran Deal Expectations

U.S. crude oil rallied towards the close but still ended lower for a second straight session on Monday, amid renewed expectations of a nuclear deal with Iran which could see easing of sanctions against Tehran.

Sanctions against Iranian oil may be lifted if Tehran reaches an agreement with the West on some long-anticipated inspections. The deadline for such a deal is supposedly Tuesday. Any easing of sanctions could see a further glut in the already oversupplied market, despite ongoing geopolitical tensions in the Middle East. In the event Iran fails to conclude an agreement with the West, oil prices may likely bounce back once again.

Tensions in the Middle East centered around the turmoil in Yemen persist, but a massive glut of U.S. inventories have helped last week's rally to fizzle out. Analysts also believe the fighting in Yemen is highly unlikely to disrupt oil shipments from the region, since most of the fighting is taking place far away from the shipping route areas.

Light Sweet Crude Oil futures for May delivery, the most actively traded contract, dipped $0.19 or 0.4 percent to settle at $48.87 a barrel on the New York Mercantile Exchange Monday. Crude prices for May delivery scaled a high of $49.16 a barrel intraday and a low of $47.61.

On Friday, U.S. crude futures for May delivery slumped $2.56 or 5.0 percent to settle at $48.87 a barrel, on speculation that concerns over the Yemen military operations may be overdone. Crude oil prices surged during the week amid concerns of disruption in oil shipment from the Middle East after Saudi Arabia launched air strikes on Yemen.

The dollar index, which tracks the U.S. unit against six major currencies, traded at 97.95 on Monday, up from its previous close of 97.36 on Friday in late North American trade. The dollar scaled a high of 98.07 intraday and a low of 97.42.

The euro trended lower against the dollar at $1.0827 on Monday, as compared to its previous close of $1.0890 in North American trade late Friday. The euro scaled a high of $1.0890 intraday and a low of $1.0811.

In economic news, personal income in the U.S. increased slightly more than expected in February, a Commerce Department report showed Monday, while personal spending is indicated to have risen less than anticipated. Personal income climbed 0.4 percent in February, matching the upwardly revised increase seen in January. Economists expected income to rise by 0.3 percent, which would have matched the growth originally reported for the previous month.

Meanwhile, the report also showed that personal spending inched up 0.1 percent in February after dipping 0.2 percent in January. Spending had been expected to edge up by 0.2 percent.

Pending home sales in the U.S. increased much more than expected in February, with pending sales jumping to their highest level in twenty months, a report from the National Association of Realtors showed Monday. NAR's pending home sales index surged 3.1 percent to 106.9 in February after climbing 1.2 percent to a slightly downwardly revised 103.7 in January. Economists expected the index to edge up by 0.3 percent.

Elsewhere, eurozone economic sentiment rose for the fourth successive month to its highest level in nearly four years as lower oil prices, weak euro and measures of the central bank boosted confidence among firms and consumers, a survey by the European Commission showed Monday. The economic sentiment index climbed to 103.9 from 102.3 in February, which was revised from 102.1. Economists expected a score of 103. This was the strongest reading since July 2011, when it was 104.

Germany's consumer prices increased for the second straight month in March, preliminary data from the statistical office Destatis showed Monday. Consumer prices rose 0.3 percent from last year after increasing 0.1 percent in February. The annual increase came in line with expectations.

The U.K. mortgage approvals rose to a 6-month high in February, the Bank of England reported Monday. The number of mortgages approved for house purchases rose to 61,760 in February from 60,707 in January. This was the highest since August and above the expected level of 61,000.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Market Analysis