As crude oil teeters on the edge of the $30s, it isn’t necessarily China or Saudi Arabia that will push prices over the edge. Rather, the final shove could come from the U.S.

This isn’t about stubborn shale supply either. Rather, the big number to watch in coming weeks is refinery utilization, which measures how much of America’s refining capacity is running to turn crude oil into products like gasoline.

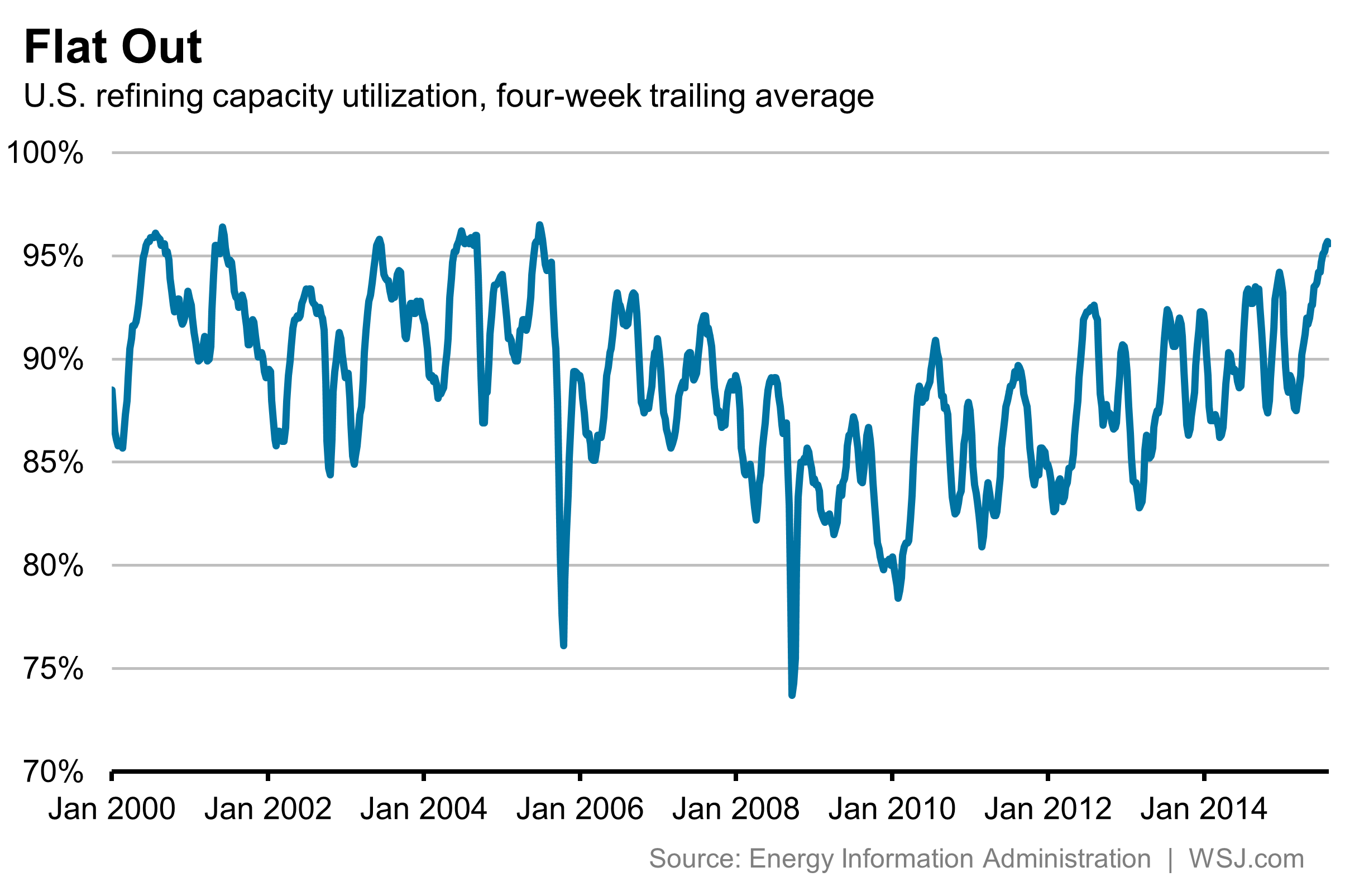

This summer, those refineries have been running flat out. On a four-week-moving-average basis, utilization has been running above 95% since the week ending July 17, according to Energy Department data. That is the highest level since the summer of 2005.

That should worry oil bulls on two fronts. First, despite U.S. refineries running at such a hot pace, sucking in crude oil, the price has still fallen by almost 30% since the start of July. Refiners have been encouraged by strong demand for gasoline: On a four-week-average basis, it is running 6.5% higher than a year ago. That likely reflects drivers simply capitalizing on average pump prices being cheaper by around 75 cents a gallon compared with a year ago, as well as strong construction markets keeping trucks on the road.

Were it not for gasoline’s strength, oil would lack any real support: Ex-gasoline, average U.S. demand for petroleum products in the past four weeks is flat on last year.

This matters because U.S. gasoline demand typically peaks around now—just before many refineries start scaling back to carry out maintenance.

And this is why a hot summer sets up a cold fall for crude. When refineries run so hard, there is greater wear and tear and risk of outages, such as the one that began earlier this month at BP’s Whiting refinery near Chicago.

The average drop in refinery utilization between the end of August and the end of October over the past two decades has been around 4.8 percentage points. In 2005, it was 15.4 percentage points, but that reflected the impact of Hurricanes Rita and Katrina.

Still, the year before that also saw a summer of where utilization ran above 95%, and the drop in 2004 was 7.1 percentage points. On current capacity, that would equate to oil demand from U.S. refineries dropping by almost 1.3 million barrels a day by the end of October. Absent big shifts in supply or demand elsewhere, and quickly, fall will certainly live up to its name in the oil patch this year.

Write to Liam Denning at liam.denning@wsj.com

Copyright ©2015 Dow Jones & Company, Inc. All Rights Reserved.