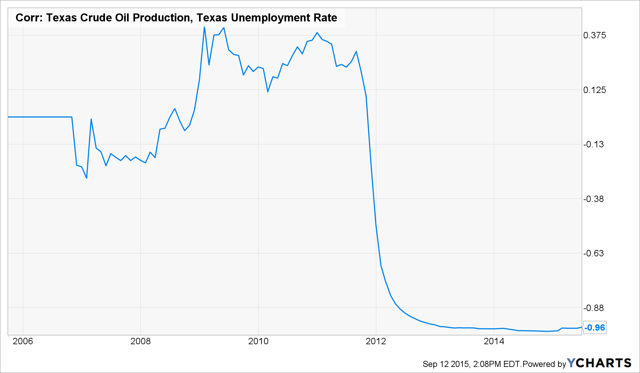

WTI production in Texas and the Texas Unemployment rate are closely correlated.

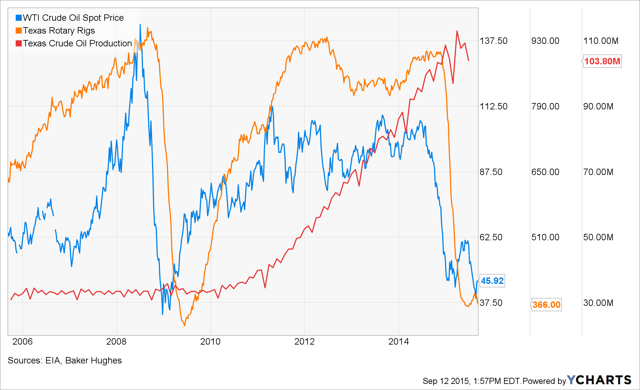

Despite reduction in Texas rig counts, production remains near all-time highs.

The full pain of low oil prices have yet to be felt in the country's second largest economy.

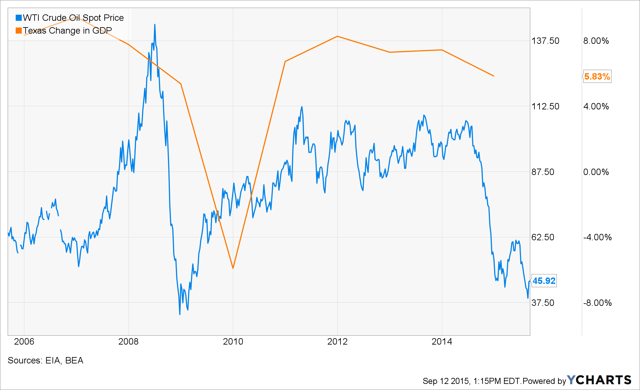

It is often cited in the press that lower oil prices have stimulating economic effects by leaving extra cash in consumers pockets from lower prices at the pump. According to the Federal Reserve Bank of Dallas' "Texas Service and Retail Sector Outlook Survey," this doesn't seem to be the case in the United States' second largest state economy - the drop in the price of WTI is having an adverse effect in the great state of Texas.

Currently, the unemployment rate in Texas is 4.6%, which is below the national average of 5.1%, however unemployment tends to be a lagging indicator. It remains to be seen how much impact the current slump in WTI has on the Texas economy. Using history as a guide, I would expect the 2015 change in GDP to be less than the 5.83% rate observed in 2014, which could have knock-on effects on hiring in the Lone Star state.

Despite Texas' energy sector strides to combat falling WTI prices by aggressively cutting rig count back to 2008-09 levels, Texas crude oil production remains near all-time highs. According to recent CNBC poll, 43% of analysts and traders see the break-even price for the U.S. shale industry of $45-$55, while only 20% see the break-even price at $45 or less. Going forward, it would seem like something's gotta give - either production drops or prices rise because WTI production in Texas remains near all-time highs while prices hover around $45 a barrel.

Being from the Midwest, I have plenty of friends and family in the Lone Star state. According to data from YCharts, the employment situation in Texas could become dire because since 2013, the correlation of Texas Crude Oil production and the Texas Unemployment rate has registered an astonishing -.96! This means that, in recent years, WTI production increases are almost perfectly correlated to an improving labor economy in Texas. Needless to say, we're all hopeful the correlation changes dramatically if and when Texas begins cutting production!