The Next Commodity Boom

The OPEC Thanksgiving 2014 decision not to cut production was the right one.

Saudi Arabia's decision to ramp up production to retain market share was not necessary and is costing the Kingdom tens of billions.

Mission accomplished, U.S. production is well into a decline. To continue overproducing at this point is a mistake by the Saudis.

Last Thanksgiving when OPEC rattled the global oil (NYSEARCA:USO) market by not cutting production we thought the decision was a smart one. It would have made no sense for the Saudis to reduce production to make room for shale growth. Ten months later we think OPEC (Saudi Arabia really) are not taking a sensible course of action by continuing to overproduce.

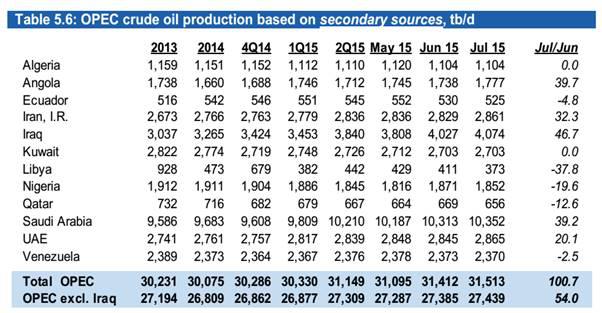

As we all know at this point, the Saudis didn't just hold production steady into a collapsing oil price. They ramped it up. The table below is from the August OPEC Monthly Oil Market Report and shows how each OPEC nation's production has trended.

Source of image: August OPEC MOMR

From 2013 through the end of 2014 Saudi Arabia kept production around 9.6 million barrels per day. This summer the Saudis have been producing at a level that is more than 700,000 barrels above that. Yes, domestic demand and increased refining capacity took care of most of this increase, but the message to the market was clear.

Our opinion is that if Saudi Arabia had simply left production at the 9.6 million barrel level we would already have an oil market that was pretty well balanced.

By overproducing by 700,000 barrels per day Saudi Arabia is costing itself a ridiculous amount of money. 10.3 million barrels of production at $50 per barrel generates $515 million of revenue per day, $15 billion of revenue per month and $185 billion of revenue per year.

If the Saudis produced 700,000 barrels less and the price of oil rebounded to $80 those revenue figures would jump to $768 million of revenue per day, $23 billion of revenue per month and $276 billion of revenue per year.

We believe the global oil market to be oversupplied by 1 to 1.5 million barrels per day, not the 3 million barrels suggested by the IEA. A Saudi cut of 700,000 barrels would bring the market much more in balance.

Saudi Arabia may be costing itself almost $100 billion per year. That cash could come in handy if for example the country was fighting a way in Yemen. The decision to put the fear of volatility back into shale producers and their creditors was a wise one. But that mission is accomplished and it is time to reverse course. Perhaps the reason that they are still overproducing is because OPEC hasn't figured out that shale production (and Non-OPEC production everywhere) is rolling over.

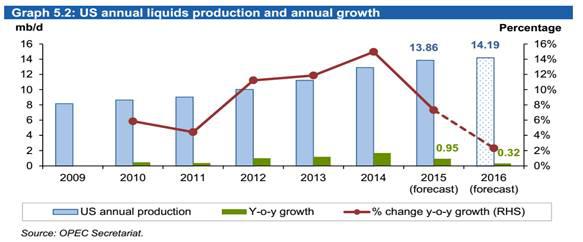

In the same August Monthly Oil Market Report from OPEC (linked earlier) OPEC is still projecting oil production growth for 2016 in the United States. They don't seem to be looking at the same market that we are. U.S. production rolled over in April and even the EIA agrees with that fact.

Source of image: August MOMR

According to the EIA (link above) U.S. production as of June is declining at a rate of 100,000 barrels per day. OPEC has not adjusted its current projections to reflect that fact. OPEC is still projecting U.S. production to increase in 2016.

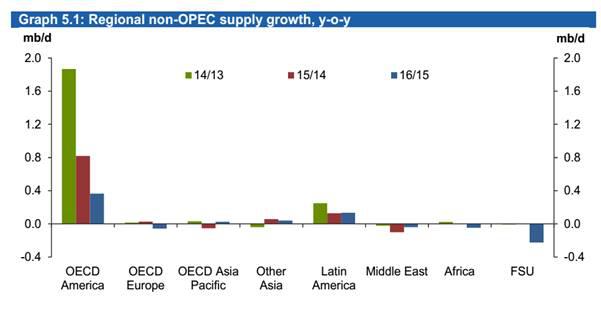

Source of image: August MOMR

With all of the doom and gloom surrounding the price of oil the importance of U.S. production heading into decline has been lost. Remember that over the past several years the only significant oil production growth on the planet came from U.S. shale. With demand increasing every year on average by a million barrels per day (much more at these low prices), it is inevitable that the market gets tight with U.S. production not only not growing, but shrinking.

And if you have a look at OPEC's chart below you can see that the U.S. is expected to be the only real source of growth in 2016 as well.

Source of image: August MOMR

So maybe the Saudi desire to keep overproducing is due to the fact that the idea that U.S. shale production is in decline has not been accepted by them yet. Perhaps when the next set of IEA numbers come out and verify that decline the Saudis will make the ration decision and stop overproducing.

The oil market will come back into balance even without the Saudis slowing down. It could be back in balance tomorrow if the Saudis would just return to 2013 / 2014 levels of production.