By Bloomberg

America’s emergency stockpile of oil stands twice as large as the amount required by an international pact. George Soros has proposed selling some now to punish Russian President Vladimir Putin -- and U.S. lawmakers are starting to listen.

As the U.S. and its European allies seek to rebuke Russia for taking over the Crimea region of Ukraine, America could push down global oil prices by as much as $12 a barrel by selling 500,000 barrels a day from its strategic reserve, said Philip Verleger, a consultant who worked in the Ford and Carter administrations. The lower prices would cost Russia about $40 billion in lost income from oil and gas sales, equivalent to 2 percent of its economy, he said.

While Energy Secretary Ernest Moniz has dismissed the idea, it was raised before a congressional hearing yesterday, less than a week after Soros discussed the subject at a panel in Berlin. The strongest sanction against Putin for taking control of Crimea “is in the hands of the United States” because America could sell oil reserves to depress prices, the billionaire investor said March 20.

“America can and should be an energy superpower,” Senator Mary Landrieu, chairman of the Energy and Natural Resources Committee, said this week at her first hearing as head of the panel. “The last thing Putin and his cronies want is competition from the United States of America in the energy race,” said the Louisiana Democrat.

Strategic Reserve

Selling U.S. oil is a more immediate option than allowing more exports of natural gas, which requires infrastructure that doesn’t yet exist, according to Verleger.

“We have plenty of oil, we don’t need this oil, we can sell this oil today and put economic pressure on Russia,” Verleger, president of PKVerleger LLC in Carbondale, Colorado, said in a phone interview.

The U.S. keeps 696 million barrels in the Strategic Petroleum Reserve, stored in underground salt caverns in Texas and Louisiana, according to the Energy Department. The stockpile was created in 1975 to protect against supply interruptions after an Arab embargo. The last major drawdown was a 30-million-barrel sale in 2011 amid unrest in Libya.

While the nation is committed to holding enough oil to cover 90 days of imports, it currently has enough for more than 200 days, according to the International Energy Agency, the organization of oil-consuming countries that coordinates stockpiles.

Test Sale

“With more domestic oil production and decreasing oil imports, the United States will rely less on the SPR to replace disrupted supply,” Elizabeth Rosenberg, a senior fellow at the Center for a New American Security in Washington, told the House Committee on Foreign Affairs at a hearing yesterday. “Therefore, it has increasing flexibility to use this stockpile to influence the market for other, possibly geopolitical, reasons.”

President Barack Obama’s administration said this month it would sell 5 million barrels of crude from the reserve to test the distribution system, including a pipeline whose flow was recently reversed. It has nothing to do with Ukraine, Moniz said at a March 21 Bloomberg Government breakfast with reporters and editors in Washington.

WTI Price

The release signaled that the U.S. is willing to use its reserves if the conflict escalates and supplies are disrupted, said Greg Priddy, director of global energy and natural resources at the Eurasia Group in Washington. The U.S. conducted two previous test sales from the oil reserve, including a 4 million barrel sale in August 1990, the month Iraq invaded Kuwait.

West Texas Intermediate crude has averaged $98.51 a barrel this year versus $107.87 for Brent, the international benchmark. Europe imports about 30 percent of its natural gas from Russia through pipelines that cross Ukraine. Oil and gas account for about 50 percent of Russia’s government revenue, the Energy Department estimates. Obama said on March 25 that Russia faces more sanctions if it encroaches further into the east of the country after annexing Crimea.

“I don’t think anyone is saying the oil markets are badly supplied,” Moniz said in the interview last week. Using the oil reserves requires a presidential declaration of emergency, he said.

Representative Tim Ryan, an Ohio Democrat, wouldn’t oppose releasing oil stockpiles along with other initiatives such as approving natural gas exports, Michael Zetts, a spokesman, said by phone yesterday.

Small Effect

The effect on oil prices would be small and temporary, according to Tom Finlon, Jupiter, Florida-based director of Energy Analytics Group Ltd. Prices quickly recovered after previous releases, he said. Brent futures rose 0.7 percent to end the session at $107.83 a barrel today on London’s ICE Futures Europe exchange. They’re down 2.7 percent this year.

The reserve exists to offset shortages in an emergency, not to manipulate prices, said Edward Chow, a senior fellow at the Center for Strategic & International Studies in Washington.

The U.S. probably wouldn’t try to push down prices because its own producers would also suffer, Amrita Sen, an analyst at Energy Aspects Ltd. in London.

“If you use oil and aim it at Russia, you’ll hit Texas,” said Kevin Book, managing director of ClearView Energy Partners LLC, a Washington-based consultant. “Besides the intrinsic problem of taking your safety net and burning it for a flash in the pan, we’re not the low-cost producer.”

Win, Win

Releasing oil from the reserve would further reduce U.S. imports while also boosting exports of finished fuels as refiners benefit from cheaper feedstocks, Carl Larry, president of Oil Outlooks & Opinions LLC, said by phone from Houston.

“We can increase exports and the U.S. wins on all levels,” Larry said. “Refiners have better margins in the U.S. and we push out exports from Russia.”

U.S. imports are declining because domestic production is growing the most in history as horizontal drilling and hydraulic fracturing unlock supplies from shale rocks deep underground. The country may be able to meet all its own energy needs by 2035, BP Plc estimates.

Domestic fields are pumping 8.19 million barrels a day, up 15 percent from a year ago, near the highest level since 1988, Energy Department data show. Net imports will decline to 25 percent of liquid fuels consumption next year, the lowest since 1971, the department predicts.

The U.S. would need to make sure that releasing stockpiles wouldn’t be offset by other producers cutting output, said Gary Hufbauer, a researcher at the Peterson Institute for International Economics in Washington. Saudi Arabia might cooperate because it opposes Russia’s role in Syria, he said.

Export Lobby

Verleger said the effect on domestic producers would be muted because they already make less than global prices. About 70 percent of U.S. reserves would remain profitable at $75 a barrel, according to Wood Mackenzie, an industry research company.

The oil industry has begun lobbying to change the ban on most crude exports, also arising from the 1970s. Exxon Mobil Corp. said in a December report it supports lifting the limits. Senator Lisa Murkowski of Alaska, the senior Republican on the Energy and Natural Resources Committee, said in a Jan. 7 speech she also supports changing the rules.

Supporters of exporting natural gas are also seizing on the Crimea crisis in an effort to accelerate approvals to sell natural gas to countries without free trade agreements, including all 28 members of the European Union.

Facilities Review

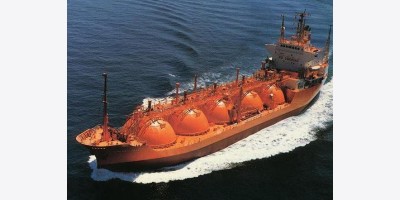

The Energy Department is reviewing more than 20 applications from companies to build multibillion-dollar facilities to liquefy gas so it can be loaded onto oceangoing tankers. On March 24, the department approved Jordan Cove Energy Project LP’s application to build a terminal in Oregon, the seventh proposal cleared since Obama took office.

If all of the seven approved LNG projects are built, the U.S. could export about 9.3 billion cubic feet a day, according to the Energy Department. The first project, Cheniere Energy Inc. (LNG)’s Sabine Pass facility, won’t be finished until late next year.

Even if the gas wouldn’t reach Europe for years, approving the projects signals that the U.S. can provide alternatives to Russian supplies, Murkowski said at a committee hearing this week.

“We are in an enviable position as a nation,” she said at the hearing. “To be able to discuss our natural gas, our oil, our other resources as truly a strategic asset is something that I think is a remarkable story.”

Philip Revzin

To contact the reporter on this story: Isaac Arnsdorf in New York at iarnsdorf@bloomberg.net

To contact the editors responsible for this story: Millie Munshi at mmunshi@bloomberg.net Philip Revzin, Margot Habiby