U.S. Set to Be the New Swing Producer

Saudi Arabia Setting Up U.S. to be New Swing Oil Producer

Just a decade ago, Saudi Arabia maintained unequivocal power over oil prices.

As the largest producer in the Organization of the Petroleum Exporting Countries (OPEC), it has the power to turn the spigot off and on during oil crashes and rebounds, essentially dictating the price of oil in the global market.

But it seems the Saudis are tiring of this role. And now, the United States is ready to take control…

Heavy Is the Head That Wears the Crown

As the chart below shows, Saudi Arabia is still the dominant producer of oil within OPEC. It has the ability to produce more oil to temper prices or cut production to bolster prices.

Most recently, the Saudis used this power to flood the market and spark the oil crash, along with the other members of OPEC, in an effort to eliminate competition from the United States.

This ability to efficiently turn on or off production makes them the “swing producer.”

But the swing producer also tends to get the short end of the stick…

You see, if OPEC were to reduce output to keep prices high for everyone, they’d lose part of their market share to other, less-efficient producers who are not reducing production, but are still benefiting from the effect of higher prices.

The Saudis have been signaling for some time that they are fed up with the role…

Saudi Oil Minister Ali Al-Naimi expressed his country’s frustration with the situation in an exclusive interview with the Middle East Economic Survey earlier this year:

“Is it reasonable for a highly efficient producer to reduce output, while the producer of poor efficiency continues to produce? That is crooked logic. If I reduce, what happens to my market share? The price will go up, and the Russians, the Brazilians, [and] U.S. shale oil producers will take my share,” said Al-Naimi.

Saudi Arabia saw the rise of shale oil from the United States and realized that it would, once again, have to lose market share in order to stay profitable.

Thus, OPEC’s refusal to cut production and keep prices high is a clear message that Saudi Arabia is done with being the swing producer.

The Saudis are hoping that prices will stay low long enough that marginal shale producers go out of business, and that those strong enough to survive will take on the role of swing producer and cut production.

And what country has been gaining ground in the oil market lately? The United States, of course…

Long Live the New King?

While the shale revolution in the United States is in full swing, it’s still quite early in the game.

You see, U.S. oil production growth wasn’t expected to peak until the mid-2020s. And that might be pushed back a bit now, as the U.S. shale producers begin to temper exploration and production until prices recover.

However, it doesn’t change the fact that the United States has the ability to ramp up production, or as we are seeing today, delay or defer production (as a group) at the drop of a hat. And the number of producers is such that we can affect global supplies, and thus prices, almost as quickly as OPEC.

Yes, the United States is ready to assume the mantle of swing producers.

This realization is putting pressure on prices.

You see, many producers, like EOG Resources (EOG) and Encana (ECA), have announced lower capital spending going forward or the intention to keep production at the same level until prices recover – essentially keeping the spigot flow steady instead of turning it on full blast. But the world oil markets just aren’t buying it.

The reason is that there are now two entities that can turn on the oil spigot at a moment’s notice, and produce significant and measurable quantities of oil, should prices increase. Not to mention that without an increase in global demand, the price of oil isn’t going to stage a miracle recovery.

The Saudis and OPEC do have the ability to cut production (which many within the cartel are clamoring for) as does the United States.

But this time, the Saudis recognize that it’s in their best interest to wait this out and hope that enough shale production is cut back or that U.S. producers decide to permanently moderate production growth in return for higher prices. Barring a surge in global demand, this process could be protracted, and so could the slump in prices.

And the chase continues,

Karim Rahemtulla

Expect low prices, more volatility in oil: Exxon CEO

Michelle Fox | @MFoxCNBC

Investors should brace themselves for more volatility in the oil market, with prices staying around current levels for a while, Exxon Mobil CEO Rex Tillerson told CNBC.

"There is the potential for there to be further pressure on the market for a period of time," he said in an interview that aired Thursday on "Squawk Box."

"I think people kind of need to settle in for what is likely to be a bit of a volatile time, and I think need to settle in for what may be volatile around this level we're at."

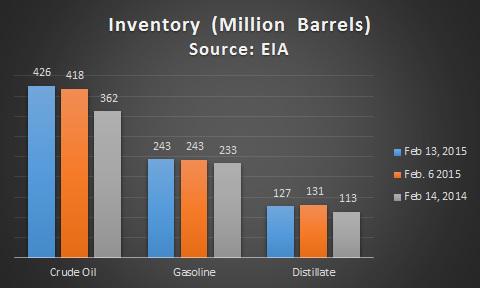

Storage facilities in the U.S. are filling up, and that could put pressure on oil prices as producers are forced to sell.

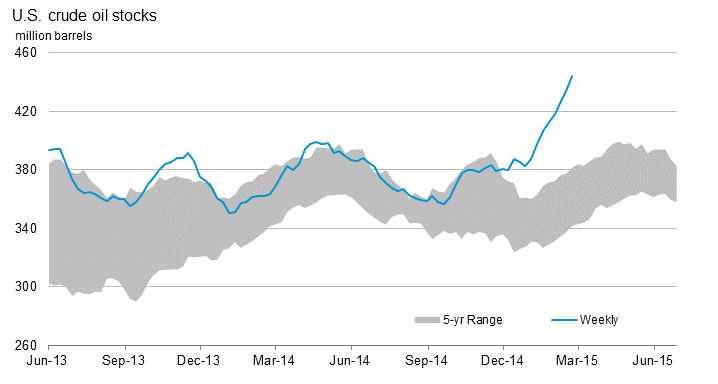

U.S. crude stocks jumped by 10.3 million barrels last week, more than double the amount predicted by analysts, according to the U.S. Energy Information Administration. Stocks at Cushing, Oklahoma, rose by 536,000 barrels, less than anticipated but still another increase at the U.S. crude contracts delivery point.

"As this North American phenomenon has occurred over the last three or four years, [the market] has been surprised at how robust and resilient this has been, and year after year, there's another million-plus barrels coming out of North America," Tillerson said.

He would not predict where oil prices were headed. He noted that U.S. crude could dip below the $40-$50 level for a period of time because of those inventory numbers or if things calm down in spots like Libya or Iraq, which could bring more oil online. Prices could also rise if there were disruptions to supply elsewhere in the world, he added.

In the next couple of years "we're going to kinda wallow around where we are with a little bit this way, a little bit that way, until some of this sorts itself out."

While U.S. producers have cut back rigs and expenditures, it will take some time before that is evident in the market, Tillerson said. What he believes is really needed is a pickup in market demand.

"If you look at the performance of the U.S. economy, it's OK but it's not robust. Europe is still struggling with declining demand and China has actually slowed its rate of energy demand growth. So all of those are conspiring to create this imbalance," he said.

On Wednesday, U.S. crude futures closed at $51.53 a barrel.

Capex cuts

Meanwhile, Exxon Mobil is cutting capital expenditures by about $4.5 billion, to $34 billion for 2015, Tillerson said. However, it is expecting an increase in production.

The CEO stressed that there has been no significant change to its investment philosophy or investment program.

"We live in a commodity world. We've been through cycles before," he said, noting that investment decision-making is not drive by the price, whether it is $40 a barrel or $100.

"It's all about the quality of the investment opportunity, which we then test, recognizing that we have huge uncertainties in these decisions we make."

He also said Exxon Mobil was in a good position to acquire companies if the right opportunity presented itself.

"We really are looking for great opportunities where a company has great assets, we see an opportunity because of what we can do with those to create value from that," he said. "We're pretty patient. We don't feel compelled to have to do anything."

On Warren Buffett selling XOM

Tillerson also responded to Warren Buffett's recent revelation that Berkshire Hathaway sold its entire stake in Exxon Mobil in the fourth quarter. Buffett also called it a "wonderful company."

"I understand he has a portfolio he has to manage," he said. "We're still a very attractive opportunity for people who want to have a piece of this part of the global economy, which will always be there in the global economy, because there's never not going to be energy demand."

Tillerson said Exxon Mobil has always considered itself to be for the long-term investor.

"People who buy our stock, they own it for generations," he said. "The stock is largely held for people who are looking to send their kids to college. We pay a lot of pension funds, dividends to people."

—Reuters contributed to this report.

Libyan state oil corporation declares 11 oil fields non-operational after suspected IS attacks

Published March 05, 2015Associated Press

TRIPOLI, Libya – Libya's state-run oil corporation has declared 11 oil fields in the country non-operational after attacks by suspected Islamic State militants, opting for a force majeure clause that exempts the state from contractual obligations.

The statement posted on Wednesday on the corporation website also warns of danger to other terminals and facilities.

The National Oil Corporation says that despite pleas for the authorities to ensure safety of Libya's oil installations, "theft, looting, sabotage and destruction" of the oil fields have been on the rise.

It cited Wednesday's attack on the al-Dhahra oil field south of the central city of Sirte, which has been blamed on Libya's Islamic State affiliate.

Before al-Dhahra, three other oil fields have come under similar assaults, including al-Mabrouk where 10 guards were killed and seven foreigners abducted.

Iraq: Isis militants 'set oilfield on fire' in Tikrit

By Arij Limam , Nigel Wilson

March 5, 2015 11:17 GMT 4 5

Iraqi security forces and Shi'ite fighters reload a weapon during clashes with Islamic State militants in Salahuddin province(Thaier al-Sudani/Reuters)

Eyewitness reports suggest Islamic State (Isis) militants have set an oilfield ablaze in the town of Tikrit, eastern Iraq.

Witnesses told Reuters news agency that black smoke had been rising from the oil field from Wednesday afternoon (4 March), as Iraqi security forces and government-aligned militias advanced on the city from the east.

The Ajil oil field is located around 35km (20 miles) east of Tikrit city centre. It was seized by Islamic State fighters last June, when it took over large parts of northern Iraq.

The field had produced around 25,000 barrels of oil per day before Islamic State seized the facility, but output is thought to have declined since then as the militants lack the expertise to operate it at full capacity.

The reports, which were cited by Al-Jazeera and Reuters, come just days after the start of an operation led by the Iraqi army to retake the Islamists' stronghold.

Some 30,000 Iraqi troops and militia, as well as military aircraft, began their biggest and toughest offensive yet on 2 March.

The battle raged between IS fighters and ground troops. Iraqi state-run TV stated on 4 March that government forces were advancing and recapturing oil fields.

Commanders from the Iraqi army were hoping that this operation would be the first of many, and a step towards re-capturing Mosul, the main Isis stronghold in the country.

Egypt may import natural gas from Israel

March 5, 2015 6:13am

TEL AVIV (JTA) — Egypt could import natural gas from Israel, according to a senior Egyptian government official.

Egypt would import the natural gas, drilled in the Mediterranean Sea off of Israel’s coast, if its price is low enough and if one of the drilling companies drops a legal action against the Egyptian government, according to the Wall Street Journal.

“We would approve the gas deal if it will meet domestic demand, offer high value for the Egyptian economy and if the international arbitration with one of the companies is resolved,” Egyptian Oil Minister Sherif Ismail told the Journal, according to Haaretz.

The legal action was brought by a joint Italian-Spanish gas venture, which has filed an international complaint against Egypt over breach of contract. The venture, Union Fenosa Gas, signed a 15-year contract last May to sell Egypt 2.5 billion cubic feet of gas from Israel’s offshore field. British energy company BG Group has also signed a 15-year contract to send 7 billion cubic feet of Israel’s gas to Egypt.

Jordan has also signed a $15 billion 15-year letter of intent to import Israeli natural gas.

Oil Won't Swing Back to $100 a Barrel Soon

Thursday, 05 Mar 2015

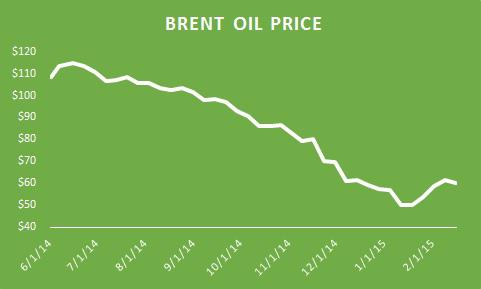

Last summer, after an unusually long period of relative stability, oil prices embarked on a downward journey, decreasing by half in just six months.

In the last few weeks, however, the market has worked on establishing a floor, enabling prices to regain some of the lost ground. Even so, they are unlikely to return to $100 a barrel soon, and the consequences of the plunge have yet to play out fully.

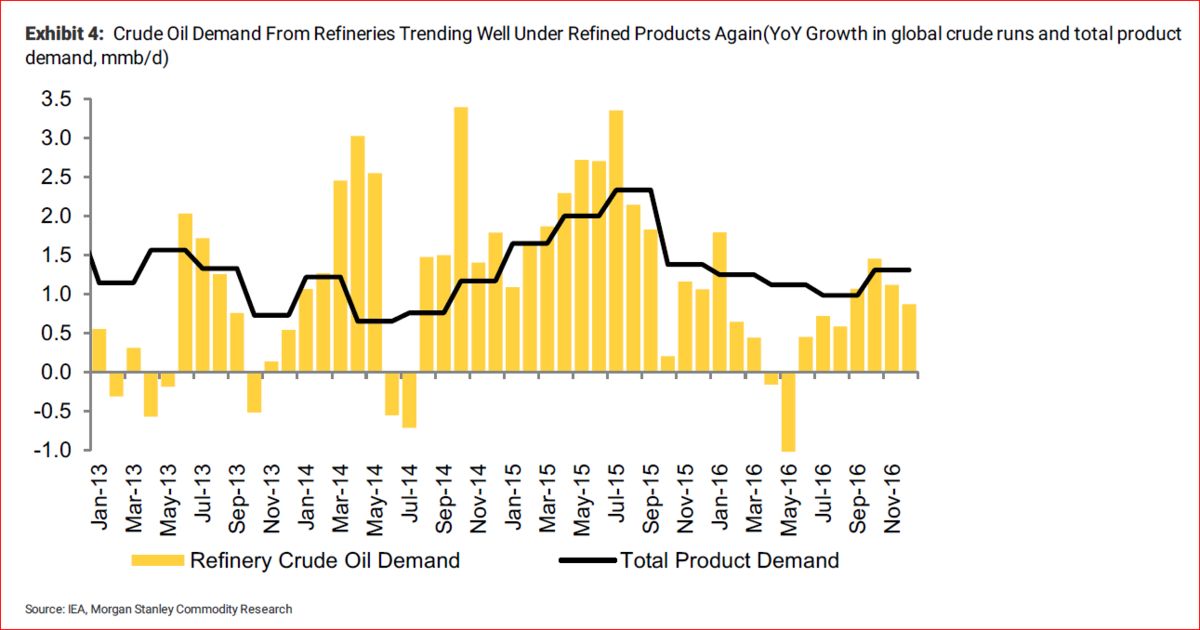

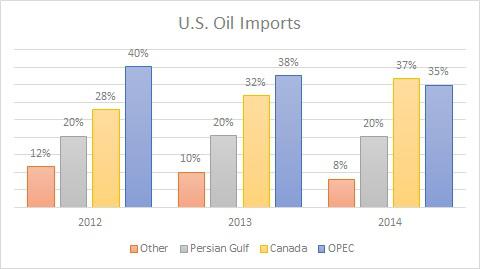

The reasons for the sharply lower oil prices include increased supply from both traditional and non-traditional sources, such as shale; lower demand, particularly from high-intensity users such as China; and a change in the willingness of the Organization of Petroleum Exporting Countries, and Saudi Arabia in particular, to continue to play the role of swing producer (lowering production in response to declining prices, which in the past provided an earlier and broader floor for the market).

The shock to oil prices reflected what economists would characterize as unusually unfavorable movements both on and among supply and demand curves. These developments in combination caught many off guard. Now, however, the sharply lower oil prices are inducing enormous supply destruction that has yet to run its course: The price drop has rendered many existing oil fields uncompetitive, curtailed alternative energy sources and stalled longer-term expansion investments.

While this supply destruction buttresses oil prices in the short- and medium-term, there are three strong reasons it will probably prove insufficient to lift prices back to the level that prevailed in the first half of last year any time soon.

First, significant demand creation appears to be materializing more slowly than expected. Part of the reason is specific to the energy market, including consumer uncertainty about the durability of lower oil prices, and the costs involved in altering energy consumption patterns. Another contributor has to do with general hesitation to take economic risk, as opposed to financial risk, particularly for companies that might consider expansion and capital investments.

Second, lower prices have created economic, financial and political pressures on some oil-producing countries — Nigeria, Russia and Venezuela — that, under certain conditions, could entail future disruptions in their supply to the global energy market. The impact has been to accentuate concerns about instability in countries such as Iraq and Libya.

Third, Saudi Arabia reaffirmed this week its November decision not to play the role of swing producer, and the oil minister added that this approach would be proven correct. More specifically, this time, the output reduction will be borne less by OPEC and more by higher-cost non-OPEC producers. As such, OPEC — and Saudi Arabia in particular — won't need years to re-establish some of the lost market share.

Assuming there is no major geopolitical shock, there are three implications for oil prices for 2015. First, expect continued consolidation, though volatile at times, with a tendency toward higher oil prices over the course of the year. Second, there will be no quick return to the $100 level. Third, low-cost producers of oil and traditional energy products will expand their market share.

© Copyright 2015 Bloomberg News. All rights reserved.

Crude Oil Price: Has it hit bottom?

The slide in crude oil prices continued from the beginning of January 2015 until it found willing buyers on January 29th, where it hit a low at $43.90 a barrel. The downtrend, which started in June last year, broke decisively in October 2014 and geared up momentum since then, only came to a rest in January this year. A reflexive push up followed, bringing “black gold” to trade at $52.65 per barrel as of today.

Looking at the monthly chart for clues of major support area shows a previous pivot low can be found all the way back to January 2009 where it was trading at $33.19.

.jpg)

Crude Oil Monthly Chart

Fundamentals aside, the push up presents an oversold market combined with short covering and locking some profit after this strong momentum to the downside as opposed to fresh buying or initiation of Long positions. Before declaring that the bottom is in, we need to keep in mind that a bottom is not a one-time event but a process where we witness back and forth actions which build a base where the market can start a reliable move out of it.In addition, keep in mind that a solid sign that bottom is in place is picking up in volatility.

Right now, even though oil found a minor support point, it is still relatively quiet out there and all we can see is a bear flag pattern on the weekly chart.

Crude Oil Weekly Chart

We believe that we are currently in the very early stages of building a base, hence a long process is a head of us. For those who are looking for a longer term, stepping in should be done slowly and only with a small partial position. Adding to the position should be done incrementally, with the possibility for lower price ahead.

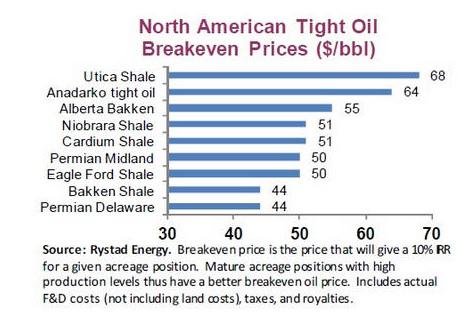

The target for this type of trade should be around the $65 -$68 areawhich coincides with the 38.2% Fib. Retracement level on the weekly chart. The fundamentals for Crude Oil, especially the continuation of weakening economies in the Europe region and China, will trump any technical analysis of the chart. In any case, a decisive break of the $40 level on a weekly closing basis should be our stop level.

Crude Oil Daily Chart

Opinion: The new era of transformation in energy

Written by David Bernal

What a difference a year makes.

Twelve months ago the shale revolution in the US was changing everything, from manufacturing competitiveness to traditional import/export flows and even longstanding geopolitical arrangements this side of the pond, shale exploration was pretty much on each EU country’s agenda, with shale gas often seen as the only way out of Russian dependency.

Now we are in the middle of another quantum shift which is transforming everything again.

Crude prices have plunged, Russia is in recession, experts are declaring shale investments dead in the water (too soon in my view) and government policies favouring renewables are under new scrutiny, as economics suddenly favour dirtier coal and gas.

Whether you blame technology, politics, softening demand or a mix of all three, these ructions are testament to the dynamic nature of energy markets and the huge risks that emerge in a period of profound volatility.

The most important question for energy market participants however, is how can we minimise our exposure?

First, a quick recap of recent events.

Technology in the form of hydraulic fracturing (fracking) and horizontal drilling has arguably made America the world’s pre-eminent oil producer, pulling up to 4m barrels a day from sources that were once called “unconventional”.

So much oil is sloshing around that Congress has taken its first tentative steps toward removal of the crude export ban by allowing exports of certain condensates.

Full-on exports of crude oil or natural gas haven’t happened yet, but exports of liquefied natural gas (LNG) will start this year. Increased trade in LNG will create a more global gas market, undermining Russia’s pipeline monopoly in Europe.

Softening demand for oil, especially from China, Japan and the euro area is another factor — along with unexpected resilience in supply from countries in the midst of conflict like Libya and Iraq.

Following OPEC’s decision to not decrease supply, the imbalance between oversupply and under-demand has driven crude to sub $50 a barrel. While consumers may see these developments as superficially positive, so much rapid, unforeseeable change always creates worry in the markets.

There is justifiable concern about how volatility will impact the flow of goods across supply chains, weaken certain shale investments and irritate commodity prices.

To a trader grappling with the practical complexities these changes create, macro analysis is only of general interest. What really matters is profitability, position visibility and the extent to which they have the freedom to make trading decisions quickly, with the most recent information.

Why transformation keeps us up at night

Companies transacting in crude oil, liquid natural gas and refined products are just beginning to understand how the current period of transformation will affect how they source, supply and move assets. Some of the variables are known and ongoing, but the last six months have shown that there are always ‘unknown unknowns’ which can dramatically re-shape the market.

Generally speaking, the major risks impacting traders’ position visibility in 2015 can be grouped around three key concerns:

1. Price volatility (how can I predict where the market will go and how do I best hedge my position?)

2. Optimisation (what is the fastest and cheapest way to procure, market and move my product?)

3. Production (for producers: how do I match output to the peaks and valleys in price and demand?)

Price volatility is obviously the first concern – which in turn makes supply chain optimisation absolutely crucial. The ability to control the costs around physical transport allows liquids traders to protect their margins against changing regulation, shifts in supply and demand, seasonal pricing fluctuations and other factors.

That’s because wherever there is a choice of route or carrier, potential savings can be identified amongst the myriad of event-based fees, gathering fees, quality fees, pipeline tariffs, storage, detention and demurrage costs that affect the price of moving assets physically from A to B.

As supply lines stretch from partner to partner across international boundaries however, the flood of data from various sources, in different formats, over multiple platforms, presents a whole new set of management challenges.

Regaining control in a volatile world

Being able to track the full commodity lifecycle for crude, LNG and refined products is absolutely essential if traders are going to profit in a period of market transformation. Too much information however can actually fog-up position visibility and slow down buy/sell decisions.

Given the accelerating pace of change we are seeing across refined products, crude oil, petrochemicals and LNG, the legacy systems traders have relied on for years are creaking under the strain of data overload, making them unreliable for providing insight and control – especially when assets are increasingly exposed to risks across an expanding global value chain.

At minimum, traders need to automate manual processes and data feeds with these capabilities:

• Manage scheduling and logistical data by visualising movement capture and actualisation of assets. This would ideally include real-time integration to a risk management engine that takes into account exposure, price and cost changes based on delivery, events, delays etc.

• Use Big Data to forecast price using historical trades and real-time price information. This will simplify estimation and measurement of price, volume and cost for better trading decisions and reporting.

• Reduce market risks with more reliable insights. The technology exists to give traders a holistic portfolio view, with risk reporting and “what-if” scenario forecasting

Knowing exactly where the money is coming from – by region, state, field, basin or well – is essential to making smart plays in a fast-moving liquids marketplace.

It requires industry-specific software with robust computing capability. This is now a baseline requirement for accurately projecting profit and loss across numerous lines of business.

The days of manual spreadsheets are over and traders will need to match the transformation in the market with their own transformation on the IT front.

According to Citi’s “Energy 2020 Out of America” report, US production surpluses are expected to continue for at least two generations, despite declining crude prices.

The impact of so fundamental a change to world oil production and consumption will continue to be felt for decades.

By contrast, EU imports of primary energy way exceed exports because of the shortfall between production and consumption. This continues to cause dependency on countries outside the EU.

There seems to be no end to the amount of oil & gas embedded in the Earth’s crust and no end to humanity’s ingenuity in finding ways to extract it. The whole concept of “peak oil” may well disappear.

“Peak technology”, meanwhile, also looks to be a long way off. By investing today in robust trading and risk management software, energy market participants can navigate market turmoil with confidence and a healthy dose of automation.

Rosneft profits drop by 10%

Written by Energy reporter - 04/03/2015 5:21 pm

Rosneft said its net profit for 2014 was $5.7billion – a 10% decrease year-on-year – caused by current economic conditions.

Russia’s top oil producer said its earnings before EBITDA were up 11.6% from the year before to 1.06trillion rubles.

Chief executive Igor Sechin said: “Despite negative changes in macroeconomic environment dividend payout ratio remains 25 percent of net income.”

Last year, the company’s net debt was at $43.8billion, down from $57.4billion at the end of 2013.

Rosneft previously asked for more than 2 trillion rubles from the National Wealth Fund, one of two Russian funds, to finance some of its prospects.

Last month, the Russian Energy minister Alexander Novak said Rosneft may get 300billion rubles from the fund to finance five projects in both downstream and upstream.

PM and Mexico leader discuss energy

Written by Energy reporter - 04/03/2015 5:57 pm

David Cameron and the President of Mexico have discussed the prospects for co-operation on energy as part of Europe’s efforts to diversify the sources of its fuel supplies away from Russia during the ongoing stand-off over Ukraine.

The discussion came as the Prime Minister hosted Enrique Pena Nieto for lunch at 10 Downing Street on the second day of his state visit to the UK.

The Mexican leader will visit Aberdeen for talks with senior representatives of the UK oil and gas sector tomorrow, when he is expected to sign a memorandum of understanding on future collaboration.

Mr Cameron’s official spokesman told reporters the two men had “talked about how the EU and Mexico can continue to co-operate on energy matters, including as part of the EU’s strategy to increase diversification away from Russian energy sources”.

The spokesman said Mr Pena Nieto “very much agreed with what the PM and other international leaders have set out about how Russia’s actions in the context of Ukraine means we can’t, as an international community, have ’business as usual’ relations with Russia”.

Mr Cameron declared his backing for Mexican former foreign minister Angel Gurria to put himself forward for a third term as secretary-general of international economic think-tank the OECD when his second term comes to an end in 2016.

Also on the table at the Number 10 talks was the strengthening of trade and commercial links, with a number of agreements being sealed during the visit, including a 400 million US dollar (£260 million) investment in Mexico by drinks giant Diageo, which purchased Tequila Don Julio last week.

And the PM’s spokesman said Mr Cameron had raised the issue of human rights and judicial reform, welcoming a memorandum of understanding agreed between the Latin American country and the Home Office on co-operation on policing and judicial matters.

Campaigners have been calling for Mexico to address the country’s upsurge in torture cases. Amnesty International UK said the nation’s nine-year-long “war on drugs” has seen more than 100,000 killings and some 22,000 disappearances.

Mr Pena Nieto has also faced public anger over the handling of the abduction and apparent murder of 43 trainee teachers by corrupt police in league with gang members. The students’ disappearance in Ayotzinapa in September sparked weeks of protests across Mexico against corruption and violence.

Mr Cameron welcomed the Mexican president with a handshake on the doorstep of Number 10.

“The relationship between Britain and Mexico is strong and getting stronger,” said the Prime Minister.

“We see that in our trade, we see that in the number of students coming to study, but increasingly we are seeing it in the co-operation between the UK and Mexico over climate change, over aid policy, over the big foreign policy and security challenges of our time.

“We are going to have detailed discussions over lunch, including on co-operation in the oil and gas sector.”

Speaking in Spanish, Mr Pena Nieto said he hoped his visit would give added impetus to strengthening a “very productive” relationship between the two countries.

Before going through to a lunch of crab salad, trout with vegetables and apple pie, the two leaders witnessed Foreign Secretary Philip Hammond and his Mexican counterpart, Jose Antonio Meade Kuribrena, signing a joint declaration on co-operation between the two countries.

Mr Cameron visited Mexico in 2012 for the G20 summit in Los Cabos, a few months before Mr Pena Nieto took office.

Mr Pena Nieto, who last night attended a state banquet at Buckingham Palace hosted by the Queen, also took part in a business leaders’ breakfast meeting with Deputy Prime Minister Nick Clegg at the Palace, before meeting Opposition leader Ed Miliband and delivering the Canning Lecture at Lancaster House.

He was also attending a banquet at the Guildhall in London given by the Lord Mayor and the City of London Corporation.

Norway's Oil Sector Confirms Spending Cuts

By Dow Jones Business News, March 05, 2015, 05:45:00 AM EDT AAA

Vote up More Sharing ServicesShare|Share on facebookShare on twitterShare on emailShare on print Subscribe

OSLO--Norway's oil and gas companies expect spending to drop 12% this year after reaching an all-time high in 2014, an official survey showed Thursday, as plunging oil prices compound an expected slowdown after years of double-digit growth.

In 2015, oil companies operating in Norway, the world's 10th-largest oil exporter, expect to invest 189.05 billion Norwegian kroner ($24.34 billion) in the industry, according to Statistics Norway's first-quarter survey.

Oil companies said they planned to spend less than previously expected on exploration and the operation of existing fields, likely due to the plunge in oil prices since last June, the statistics agency said.

The survey was roughly in line with expectations.

Spending last year reached at an all-time high at 214.31 billion kroner, but was up only 1% from the previous year, compared with double-digit percentage growth in each of the preceding three years.

Industry association Norwegian Oil and Gas has forecast spending to peak in 2014, but to remain high and stable for the rest of the decade.

Norway's oil sector has roughly tripled spending in the past decade, as high and stable oil prices triggered the development of previously unprofitable projects, and costs were boosted by capacity constraints in the global oil-field services industry.

In 2010, oil companies cut their spending in Norway after the global financial crisis led to a temporary setback in oil prices, but as prices rebounded, Norwegian oil and gas investments grew 16% in 2011, 17.5% in 2012 and 22.1% in 2013, according to the statistics agency.

However, rising costs threatened profits already before the recent oil plunge. Norway's dominant oil producer, Statoil ASA (STO), introduced last February a cost-cutting program which was boosted a further 30% this year, targeting cost cuts of $1.7 billion by 2016.

Norway produced 1.4% more oil and gas last year at 3.73 million barrels of oil equivalent a day, according to the Norwegian Petroleum Directorate. Out of that, its crude oil output rose 3% to 1.51 million barrels a day, the first increase in 13 years, but production has still more than halved since the peak in 2000.

Write to Kjetil Malkenes Hovland at kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

Copyright (c) 2015 Dow Jones & Company, Inc.

21st Century Energy Markets: EIA

Below are highlights from the statement given by Adam Sieminski, Administrator, EIA, before the Committee on Energy and Commerce on 21st Century Energy Markets.

Oil prices

“Since the middle of last year, the global supply of crude oil and petroleum products has exceeded consumption, leading to growth in global oil inventories. From their 2014 high point in June, prices fell as the worst fears of the impact of the so called Islamic State on Iraq’s oil production failed to materialise, US production continued to grow robustly, and significant Libyan supplies unexpectedly returned to the market for several months starting in late summer. At the same time, global oil demand growth and expectations for future demand growth were reduced as data from key markets, including China, showed economic growth coming in below consensus expectations at the start of 2014. EIA estimates that commercial oil inventories help by countries in the Organisation for Economic Cooperation and Development (OECD) at the end of January were 203 million bbls (3%) higher than the same time lat year, the largest year over year increase in at least the last three decades. Put in historical context, this recent inflexion point in oil markets is not the first. The global oil market has experienced a number of significant upward and downward price movements over the last 40 years.”

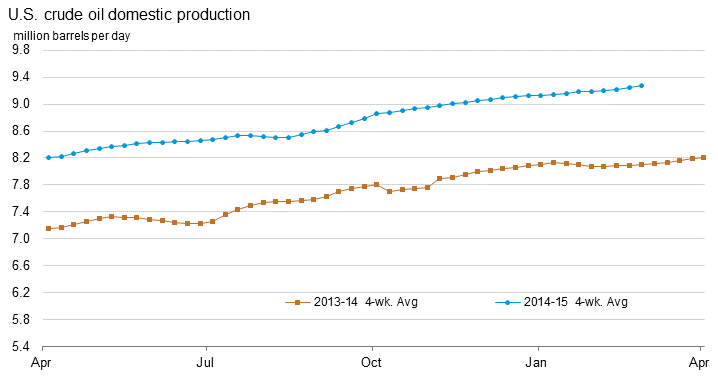

Global oil supply

“Global supply of crude oil and other liquids grew 2.1 million bpd in 2014 despite unchanged total production from member countries of the Organisation of the Petroleum Exporting Countries (OPEC). The US was the main contributor to global supply growth, adding 1.6 million bpd including 1.2 million bpd of increased crude oil supply. In 2015 and 2016, non-OPEC supply continues to grow under EIA’s price forecast, but more slowly than in recent years, with year over year growth averaging 0.8 million bpd/y. The slower growth in non-OPEC supply is largely attributable to slower production growth in the US, Canada and South America.”

“EIA estimates that OPEC crude oil production averaged 30.1 million bpd in 2014, unchanged from the previous year. Crude oil production declines in Libya, Angola, Algeria, and Kuwait more than offset production growth in Iraq and Iran. EIA expects OPEC crude oil production to fall by 0.1 million bpd in 2015, and to fall by 0.4 million bpd in 2016. Iraq is the largest contributor to OPEC production growth over the forecast period, but its growth is expected to be offset by production declines from other OPEC producers.”

Global oil consumption

“EIA estimates that global oil consumption grew by 0.9 million bpd in 2014, averaging 92.1 million bpd for the year. EIA expects consumption to grow 1 million bpd in both 2015 and 2016. Projected global oil consumption weighted real GDP, which increased by an estimated 2.7% in 2014, is projected to grow by 2.8% in 2015 and 3.2% in 2016.

“Non-OECD Asia accounts for more than 50% of forecast oil consumption growth over the next two years. Chinese oil consumption, the main source of the growth, is projected to increase in 2015 and 2016, but at a lower rate than in 2014. Projected declines in Russia’s oil consumption because of its economic downturn also contribute to lower non-OECD consumption growth over the forecast period compared with 2014.

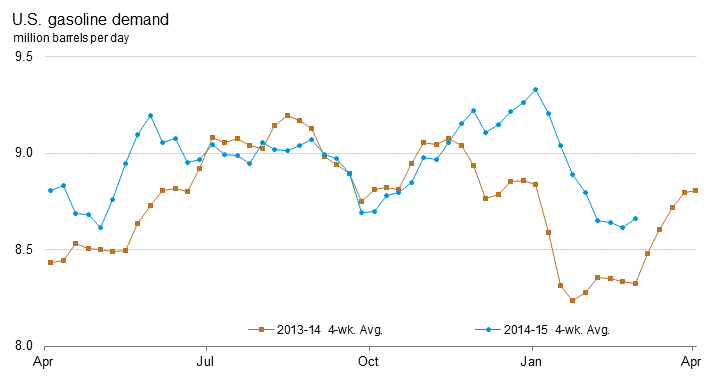

“OECD consumption, which fell by 0.3 million bpd in 2014, is expected to rise modestly in 2015 before declining slightly in 2016. The US is the leading contributor to projected OECD consumption growth, with US consumption increasing by 0.3 million bpd in 2015 and 0.1 million bpd in 2016. Demand in Japan and Europe is expected to continue declining over the next two years, albeit at a lesser rate than in 2014.”

The economy and consumers

“EIA’s energy forecast reflects a US economic growth outlook for 2015 – 2016 that is somewhat stronger than the 2013 – 2014 experience. Energy expenditure as a share of GDP are forecast at 6.2% in 2015, their lowest level since 2002, reflecting both lower oil prices and ongoing increases in energy efficiency. Consumers are receiving a direct benefit from lower oil prices.”

Linkages between US and global energy markets

“As we work to keep up with rapidly changing energy markets, one set of questions we face involves the relevance of international energy markets to the US as our oil and natural gas production surges, and our net dependence on energy imports declines. Despite these trends, the connectedness of the US to global energy markets is actually increasing in some important respects.

“Notwithstanding declining US net oil imports, producers in the countries of the Persian Gulf region, who hold very large reserves of easy to develop oil, will continue to play a central role in oil markets. Developments in that region and decisions made by producers affecting both production levels and the development of their resources have a direct effect on oil prices that in turn affect producers and consumers everywhere, including the US. Global interconnections are also readily apparent on the demand side of oil markets. The US, already the world’s largest exporter of petroleum products, has a keen interest how overseas demand for various petroleum products will evolve. More broadly, future trends in global oil demand largely hinge on the rate of consumption growth in the Middle East and non-OECD Asia, including but not limited to China and India. Demand as well as supply will be a key influence on future oil prices, with outcomes having direct implications for both US producers and consumers.

“Natural gas markets are also increasingly interconnected. Not long ago, the North American natural gas market, dominated by the US, was largely isolated from other global regions. The advent of shale gas, which greatly increases the US resource base, could allow the US to be a significant exporter of LNG. The extent to which this actually happens will depend significantly on natural gas demand, supply, and price conditions throughout the world, as well as on future oil prices, given competition among fuels and the use of oil linked price contracts. Provided that market conditions favour investment in liquefaction capacity to support higher levels of US LNG exports, decisions by policymakers regarding the approval of proposed projects will also come into play.”

Edited from statement by Claira Lloyd

Published on 04/03/2015

ExxonMobil predicts higher output

New York - US oil giant ExxonMobil said on Wednesday it would reduce investment spending by nearly 12% this year in response to lower crude-oil prices, but projected higher production.

Exxon Mobil told analysts in New York that it planned capital spending of about $34bn in 2015, down from $38.5bn on in 2014.

For 2016 and 2017, investments, including on exploration for oil and gas, were projected at around $34bn annually, said the world's largest publicly traded oil and gas company.

That was $3bn less per year than in previous forecasts.

Crude oil prices have dropped more than 50% since last June, pushing energy companies and their contractors to cut back spending.

Rex Tillerson, ExxonMobil chairperson and chief executive, noted the cyclical nature of the oil and gas industry.

"We remain focused on the fundamentals," he told analysts. "We've been here before."

ExxonMobil said it expects to start up 16 major oil and natural gas projects during the next three years.

"ExxonMobil has a deep and diverse portfolio of opportunities around the world and a total resource base of more than 92 billion oil-equivalent barrels," Tillerson said in a statement.

"We have unparalleled flexibility to select and invest in only the most attractive development projects."

ExxonMobil said it expected to increase daily production to 4.1 million barrels in 2015, an increase of 2.5%from the prior year, and to 4.3 million barrels by 2017.

Tillerson said the projections were based on a Brent crude price of $55 a barrel. Brent was fetching $60.58 a barrel in afternoon trade in London.

The Irving, Texas-based company said the improved production would be supported by a ramp-up of several projects completed last year and new projects in 2015.

Seven new major developments planned this year include Hadrian South in the Gulf of Mexico, expansion of the Kearl oil-sands project in Canada, Banyu Urip in Indonesia and deepwater expansion projects at Erha in Nigeria and Kizomba in Angola.

According to analysts, ExxonMobil is the oil company best-positioned to weather the decline in crude prices.

ExxonMobil raised $8bn in the largest bond offering in the company's history, Bloomberg News reported on Wednesday.

Shares in ExxonMobil, a Dow component, fell 0.4% to $87.26 in morning trade on the New York Stock Exchange.

Moody’s expects low oil prices to pressure GCC banks Agency foresees resilience in lenders’ ratings

Dubai, March 4: In a new report that analyzes the likely impact of a prolonged period of low oil prices on banks from the Gulf Co-Operation Council (GCC), Moody’s says it expects that the unique interlinkages that exist between oil, public spending and banks in the region will first result in reduced banking system liquidity, with secondary effects on credit growth and profitability. Nonetheless bank ratings are expected to remain broadly resilient.

The report analyzes the various channels through which a prolonged period of low oil prices will affect banks in thY region, showing that it is not through their direct exposures to the oil sector that the banks would be affected but rather through reductions in their government related deposits and the heavy reliance of the economy on public spending, both of which will be affected by lower earnings from oil.

“As a result of sustained low oil prices, we expect banking systems in the region will primarily face a decline in liquidity as government-related deposit inflows are reduced” says Khalid Howladar, Senior Credit Officer at Moody’s.

According to Moody’s, government-related deposits provide a substantial 10% to 35% of banks’ non-equity funding. At the same time, Moody’s also expects that lower oil prices will weigh on confidence and hence economic growth, leading to weaker lending growth and, ultimately, lower profitability. Nevertheless, the rating agency anticipates broad resilience in the GCC banks’ fundamental credit profiles given their robust capital and liquidity buffers.

“The GCC banks’ stock of liquid assets are healthy and their reliance on market funding is generally limited, leaving some headroom for banks to adjust to changing funding conditions in an orderly fashion” explains MP Howladar. “Furthermore, the downside effects of the lower oil prices projected for 2015 and 2016 are likely to be moderated by the proactive policy responses of GCC governments, which implies that each of the GCC banking systems will display varying degrees of resilience that are broadly in line with the pressures faced by their respective sovereigns” adds the Moody’s analyst.

The rating agency notes that Kuwait (Aa2 stable), Qatar (Aa2 stable), Saudi Arabia (Aa3 stable) and the United Arab Emirates (Aa2 stable) are able to better support their economies and banking systems due to their sizeable reserves, whereas banks operating in Bahrain (Baa2 negative) and Oman (A1 negative) are more vulnerable to L more pronounced or more prolonged period of low oil prices than expected.

“The Oman and Bahrain banking systems are the most vulnerable to a long-term drop in prices. Both sovereigns have a weak combination of high fiscal break-even oil prices and relatively low or near zero reserve buffers” noted Nitish Bhojnagarwala, an Assistant Vice president at Moody’s. Moody’s central assumption is that oil prices will average $55/barrel (Brent) in 2015, rising to $65 on average in 2016.

Kuwait oil seen at $50 in 2015 Supply glut continues

KUWAIT CITY, March 4, (KUNA): Average price of Brent oil is forecast to reach $55 in 2015, equal to $50 for the Kuwaiti oil barrel, as year 2015 will suffer an oversupplied market but will be more balanced in 2016, said Kuwaiti oil expert Mohammad Al-Shatti on Wednesday. He added in remarks to KUNA the average price of Kuwait crude reached $42.2 pb last January, compared to $51.9 pb last February, an increase of $10 pb, he said.

Oil prices are weakening during the second quarter of this year, however they will recover during the second half, as Brent oil prices are hiking towards $60 pb, thus reflecting positive market conditions, he said. Decrease of the oil prices started to affect the United States production of crude oil, as US Energy Information Administration (EIA) lowered production estimations in 2015 from $9.42 million barrels to 9.3 million barrel daily, he added.

Challenge

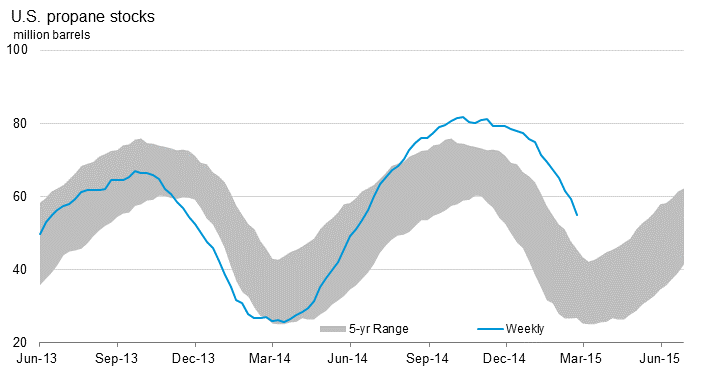

Cold weather has contributed to supporting heating oils’ prices in the US, whereas a number of oil refineries shut down due to strikes, thus posing a challenge to the US crude oil prices. Improving oil prices are connected to two factors; market supplies and US dollar rate vis-a-vis other major currencies.

Meanwhile, a number of positive indications are contributing to stability and recovery of oil prices during the near future, including the drop in crude prices, which compelled companies to decrease investments in exploration and drilling, thus helping in demand stimulation, Al-Shatti said.

There is also a number of technical and geopolitical factors, namely situation in Libya, Iran’s nuclear negotiations, Iraq’s ability of oil production, stability of Organization of Petroleum Exporting Countries’ (OPEC) production, non-rising supply, Ukrainian crisis and its effects on Russian oil production, decreases in growth rate of shale oil, and signs of recovery in the Japanese and European economies as well as the strength of US economy.

Meanwhile, there is a number of other negative factors affecting oil prices, namely putting a large number of oil refineries under maintenance in various parts of the world during the coming months, which weakens demand on oil, and thus affects the oil prices, besides the Iraq’s plans of increasing production abilities and continuous rise of US crude oil production to high levels, he said.

KOC to develop a number of oil fields Kuwait to produce 3.15mb oil daily

KUWAIT CITY, March 3, (KUNA): The strategic plan for Kuwait Oil Co (KOC) is to produce 3.150 million barrels of oil daily through the years 2015 and 2016, indicated the CEO of the company Hashim S. Hashim in a press statement on Tuesday.

Also in KOC’s near future pipeline is to develop a number of oil fields in areas all across the country, with the ultimate goal of producing no less than 3.650 million barrels of oil by 2020, representing KOC’s contribution to an overall national ambition to produce at least 4 million barrels of oil daily by that time, said Hashim on the sideline of the Global Oil and Gas Conference and Exhibition organized here by KOC.

On Kuwait’s current oil production output, he said it ranged from 2.9 to 3 million barrels a day, noting that KOC was active in augmenting its oil reserves and discoveries of new wells, a number of which have recently been discovered in the north and west of Kuwait and are currently being developed for eventual use.

Regarding the company’s investments in energy projects for the next five years, he said it had earmarked KD 12 billion for that. The “Global Oil and Gas Conference and Exhibition” previously known as the Town Hall Meeting between KOC and energy contractors is an initiative started by KOC in 2009 in order to strengthen the business partnership with its contractors and subcontractors towards achieving excellence in performance in line with KOC’s strategic objectives.

This year, being the 7th anniversary year, the participation of KOC business partners is liable to enhance the level of the event’s objectives and achievements and should result in broader business relationships and knowledge base expansion. The conference and exhibition will run from March 3-5 and will tackle oil and gas industries’ issues including best means of extracting and producing oil and gas and methods of refining crude oil, among other considerations

ExxonMobil to start up 16 major oil and gas projects

Exxon Mobil Corporation expects to start up 16 major oil and natural gas projects during the next three years and is on track to increase daily production to 4.3 million oil-equivalent barrels by 2017.

“Our long term capital allocation approach has not changed,” said Rex W. Tillerson, Chairman and CEO, at the company’s annual analyst meeting at the New York Stock Exchange. “We remain committed to our investment discipline and maintaining a reliable and growing dividend. Our integrated model along with our unmatched financial flexibility enable us to execute our business strategy and create shareholder value through the commodity price cycle.”

In 2015, ExxonMobil expects to increase production volumes by 2% to 4.1 million oil equivalent bpd, driven by 7% liquids growth. The volume increase is supported by the ramp up of several projects completed in 2014 and the expected startup of seven new major developments in 2015, including Hadrian South in the Gulf of Mexico, expansion of the Kearl project in Canada, Banyu Urip in Indonesia and deepwater expansion projects at Erha in Nigeria and Kizomba in Angola.

In 2016 and 2017, production ramp up is expected from several projects including Gorgon Jansz in Australia, Hebron in Eastern Canada and expansions of Upper Zakum in United Arab Emirates and Odoptu in Far East Russia.

“ExxonMobil has a deep and diverse portfolio of opportunities around the world and a total resource base of more than 92 billion oil equivalent barrels,” Tillerson said. “We have unparalleled flexibility to select and invest in only the most attractive development projects.”

ExxonMobil anticipates capital spending of about US$34 billion in 2015 – 12% less than in 2014 – as it continues to bring major projects online. Annual capital and exploration expenditures are expected to average less than US$34 billion in 2016 and 2017.

“We are capturing savings in raw materials, service, and construction costs,” Tillerson said. “The lower capital outlook also reflects actions we are taking to improve our set of opportunities while enhancing specific terms and conditions and optimising development plans.”

ExxonMobil’s Downstream and Chemical businesses remain resilient in the lower commodity price environment and continue to generate solid cash flow, helped by abundant North American crude and natural gas supplies that have led to lower feedstock and energy costs.

Approximately 75% of ExxonMobil’s refining operations are integrated with chemical and lubricant manufacturing, resulting in economies of scale and greater flexibility to produce higher-value products, including diesel, jet fuel, lubes and chemicals based on market conditions.

2014 highlights

ExxonMobil distributed US$23.6 billion to shareholders in the form of dividends and share repurchases, for a total cash distribution yield of 5.4%.

Return on average capital employed was 16.2% – more than 5 percentage points higher than its nearest competitor. During the past five years, return on capital employed averaged 21%, also about 5 percentage points above its nearest competitor.

Upstream profitability of US$19.47/bbl led competitors and increased by US$1.44/bbl compared with 2013.

ExxonMobil replaced 104% of production by adding proved oil and gas reserves totalling 1.5 billion oil equivalent barrels, marking the 21st consecutive year the reserves replacement exceeded 100%.

Cushing And Gulf Coast Storage Filling Up Fast

Mar. 5, 2015 3:09 AM ET | Includes: BNO, DBO, DNO, DTO, DWTI, OIL, OLEM, OLO, SCO, SZO, UCO, USL, USO, UWTI

Cushing, Oklahoma

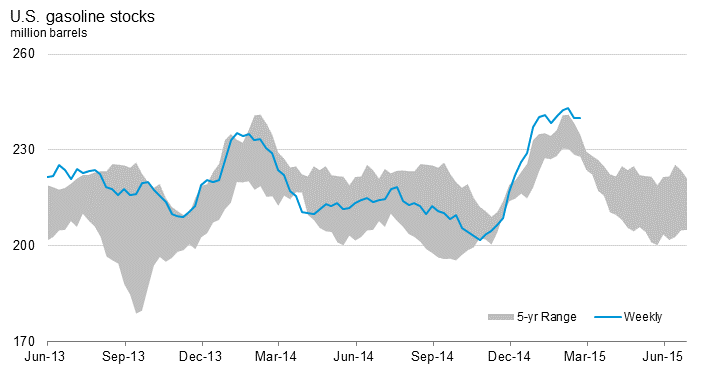

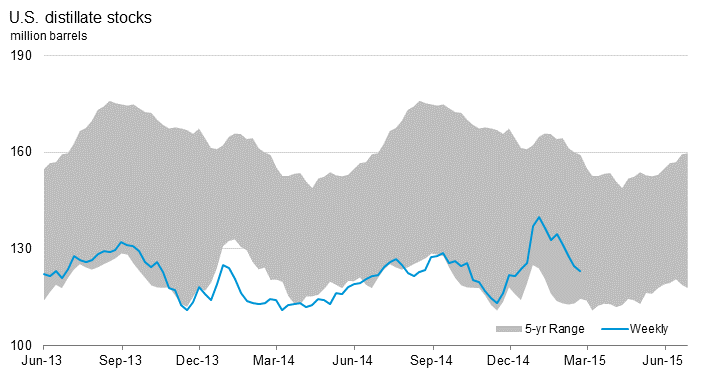

The weekly EIA Inventory report came out today regarding the state of the oil market from the supply side, and the numbers continue to paint a bearish picture of the oil market. For example, Cushing added another one and a half million barrels to storage this past week, that's three million added over the last two weeks to storage facilities.

Gulf Coast Region

The Gulf Coast is even worse adding another 5 million barrels to storage last week, and over 9 million added to storage in the Gulf Coast region over the last two weeks. And we are still a long way from the summer driving season, we can build all the way up until May in some years, it is going to be quite interesting what happens when the storage facilities fill up completely.

Wholesale Product Supplies Bloated

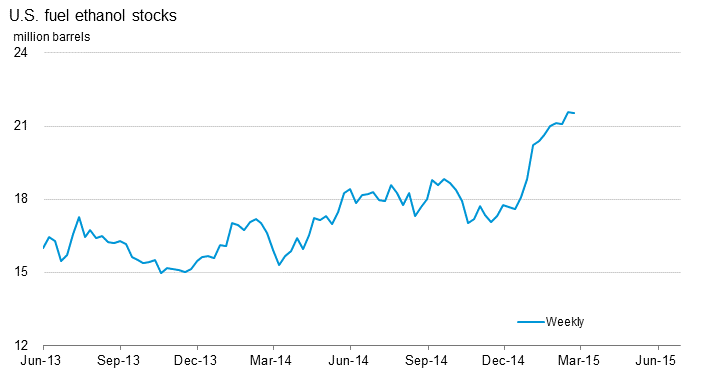

One possible solution would be to ramp up all refineries to max capacity but the downside for that option is that gasoline and heating oil are already well above last year's levels at the wholesale level, so not a lot of appetite by wholesalers to take on this suicide mission.

Bang the Close

Oil, WTI was up today on this bearish news but remember oil is another one of the most manipulated markets out there, always has been, and seems like it always will be, they like to get everyone leaning bearish, and try to squeeze them at the close, one of the oldest tricks in the books for the oil market.

In fact, many trading firms have been fined at the oil majors for messaging and chatting the time old phrase "Bang them at the Close", so this doesn't really tell us anything regarding the oil market other than a bunch of traders got squeezed at the close on a bearish inventory report.

It happened last week and the following day they took oil where the report intuitively made common sense back to the $48 a barrel level. This actually is a common occurrence in the oil market, take it up on a bearish inventory report, and sell it off the following trading day, as the newbies curse themselves over their 'unfortunate luck' at getting squeezed at the close as oil seemingly does the impossible!

20/40 Inventory Club

Lots of people are calling for a bottom in oil right now, maybe they are right, maybe new money has come into the market with the March Month of fund flows, but the actual inventory numbers are as bearish as ever. WTI is up around $4 on roughly 20 million barrels of inventory builds the last two weeks, and close to $8 on roughly 40 million barrels of inventory builds since the beginning of February. I know the CapEx numbers have been cut, but this isn't going to affect current production run rates anytime soon, and the U.S. production numbers bear this point out. Still have to have some place to store all this oil!

RIG Counts Misleading

The RIG Count has dropped also but this is a misnomer because unlike in 'old fashioned drilling times' where one rig represented one well, now one RIG often represents multiple wells attached to the one rig due to modern drilling technology. So many firms still have wells they are continuing to bring online for the existing rigs which already have producing wells on those same rigs, this helps explain why the rig count is going down but the U.S. production numbers keep climbing.

Next Leg Down

The smaller shale producers are still slightly profitable at current prices believe it or not, due to hedges and lower drilling costs as a result of technological innovation, and we haven't seen any major consolidation plays so far with the big boys buying up the small producers. I think it will take the next leg down in the oil market for the small players to lower their asking price to fuel some major acquisition deals, a lot of analysts are calling for this as well. We had a cold winter, but it didn't last near long enough to burn off the products side of the equation.

Inventory Builds Just Beginning

And now that winter is essentially behind us, and the summer driving season is still months away, here come the inventory builds, and we will see if in fact oil has bottomed or is going to take that dreaded next leg down, which all the small producers are holding out against hoping this scenario doesn't come to fruition. Time will tell but today's inventory report doesn't show any light at the end of the tunnel, things look as bearish as ever from the supply side of the equation with demand remaining flat. Every week you think this will be the week where we get a slight drawdown, we even get an occasional tease with the API numbers, but then reality sets in with the EIA Numbers, and we set another storage record in the United States!

Brent sticks above $60; Iran news offsets bearish US stockpiles data

Brent crude was flat on Thursday, managing to hold above $60 a barrel as investors brushed aside bearish U.S. inventories data to focus on the lack of a deal in talks over Iran's nuclear program.

Tehran's ambassador to the International Atomic Energy Agency (IAEA) said on Wednesday no deal had been reached on the duration of any possible final agreement with world powers on Iran's program. That allayed investors' fears of an imminent rise in Iranian oil supply.

Brent crude was flat on Thursday, managing to hold above $60 a barrel as investors brushed aside bearish U.S. inventories data to focus on the lack of a deal in talks over Iran's nuclear program.

Tehran's ambassador to the International Atomic Energy Agency (IAEA) said on Wednesday no deal had been reached on the duration of any possible final agreement with world powers on Iran's program. That allayed investors' fears of an imminent rise in Iranian oil supply.

Brent has traded around $60 since mid-February, rebounding from a six-year low of about $45 hit in January.

The April contract inched up 5 cents to $60.60 a barrel by 0503 GMT while West Texas Intermediate (WTI) crude rose 22 cents to $51.75 a barrel.

A 2 percent gain in the previous session narrowed WTI's spread with global benchmark Brent to less than $9 a barrel.

"We've got a technically more constructive picture now," Michael McCarthy, chief strategist at CMC Markets in Sydney said, pointing to the end of seven straight months of oil price falls.

"That could be contributing to the surprisingly bullish reaction to the overnight news," he said.

Government data showed commercial crude stockpiles in the United States hit a record high, rising 10.3 million barrels last week, twice as much as expected, but that failed to push prices down.

"The rate of stock build has accelerated week by week throughout February and with upcoming refinery maintenance likely to weaken demand for crude, it is possible that this will continue in March," BNP Paribas analysts said in a note.

Saudi Arabia's oil minister voiced cautious optimism about the market outlook on Wednesday, saying he expected oil prices to stabilise.

A deteriorating security situation led Libya's state oil company to declare force majeure on 11 of its oilfields on Wednesday.

"It's not a huge difference but supportive of the market overall," McCarthy said.

Output from the OPEC producer was at more than 400,000 barrels per day on March 1.

The U.S. Is Pumping Even More Oil and Storage Tanks Are Getting Filled to the Brim

American oil

The U.S. is pumping oil faster than at any time since 1972, and storage tanks are getting filled to the brim.

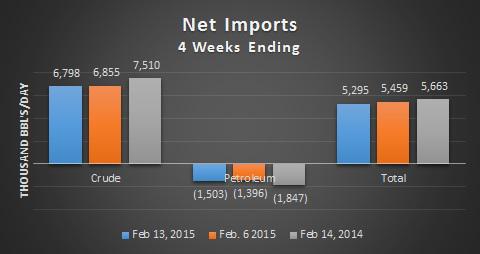

U.S. oil production rose for the fourth consecutive week, to a rate of 9.3 million barrels a day, even as oil-drilling rigs are being idled at an unprecedented rate. U.S. inventories also rose, for the eighth consecutive week, jumping 2.4 percent to 444 million barrels, the U.S. Energy Information Administration reported today.

Rising Production Versus Declining Rigs

U.S. oil storage is bursting at the seams amid a global glut of supply that has driven prices down by half since last summer. U.S. inventories remain at their highest levels in at least 80 years, according to an analysis by Bloomberg Intelligence.

Exxon told investors in a presentation today that it's sticking to its production targets established when oil traded for more than $100 a barrel. Saudi Arabia's oil minister, Ali Al-Naimi said in Berlin today that his country won't cut output either.

U.S. Crude Rises on Cushing Slowdown; Discount to Brent Narrows

(Bloomberg) -- U.S. oil futures gained for a second day, narrowing their discount to international prices as supply growth at the biggest U.S. hub slowed.

West Texas Intermediate oil climbed 2 percent as its discount to Brent shrank to the smallest in two weeks. Stockpiles at Cushing, Oklahoma, the delivery point for WTI futures, increased 536,000 barrels last week, the Energy Information Administration said. Supplies at the hub had grown by more than 1 million every week this year up until now.

“Cushing is the first glimmer of hope the bulls have had in a long time,” Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by phone. “The Nymex delivery site could soon see a draw.”

WTI for April delivery gained $1.01 to $51.53 a barrel on the New York Mercantile Exchange. The volume of all futures traded was about 47 percent above the 100-day average for the time of day.

Brent for April settlement fell 47 cents, or 0.8 percent, to $60.55 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude was at a premium of $9.02 to WTI, down from $10.50 Tuesday and the smallest gap since Feb. 19.

“What we’re seeing is the WTI-Brent spread consolidate,” Gene McGillian, a senior analyst at Tradition Energy in Stamford, Connecticut, said by phone. “There are people who locked in big profits when the spread widened and now want to get out.”

Supplies Doubled

Supplies at Cushing increased to 49.2 million last week, the EIA, the Energy Department’s statistical arm, said. Cushing supplies have more than doubled since November.

WTI also gained as the Federal Reserve said most of the economy continued to expand from January through mid-February, with consumer spending rising, manufacturing gaining, and businesses optimistic about sales.

Futures dropped in earlier trading after the EIA report showed total U.S. crude inventories advanced 10.3 million barrels last week, the biggest weekly gain since March 2001. Analysts surveyed by Bloomberg had expected an increase of 3.95 million.

Highest Level

Stockpiles climbed to 444.4 million last week, the highest level since EIA began weekly data in 1982, according to the Energy Department’s statistical arm.

“That’s a pretty wild build,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “This makes the case for another price dip start to look very serious. It’s hard to believe we can keep seeing supplies go up at this rate without another major price hit.”

U.S. crude production grew to 9.32 million barrels a day last week, the most since EIA weekly data starting 1983. U.S. refineries operated at 86.6 percent of their capacity, the lowest level since Jan. 16.

“With refineries running at well under 90 percent of capacity, inventories are going to continue to soar,” John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone.

Saudi Arabia pledged to supply as much oil as its customers need. The country won’t cut output unless customers refuse to buy its crude, Oil Minister Ali Al-Naimi said in Berlin on Wednesday. That’s unlikely to happen because it is the world’s most reliable supplier, he said.

“You know my philosophy, let the market alone,” he said. “We don’t want to disturb the market.”

Saudi Arabia increased the pricing terms for its Arab Light grade to Asia by the most in three years after the kingdom’s oil minister said last month that demand is growing.

Saudi Arabia led a November decision by OPEC to maintain output and defend market share against U.S. shale producers, exacerbating a glut that drove prices almost 50 percent lower in 2014.

“There is no fundamental reason for oil to go higher,” said Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors. “Any rally will be sold into. We are going to continue to see more supply builds in the next few weeks.”

Exxon Says Output Growth on Track Even as Crude Price Drops

(Bloomberg) -- Exxon Mobil Corp. is sticking to production targets established when oil traded for more than $100 a barrel, signaling confidence that demand for crude-based fuels will continue to expand.

Exxon’s oil and natural gas output will grow by 2 percent this year and 3 percent annually in 2016 and 2017, the world’s largest energy producer by market value, said in a presentation to investors and analysts Wednesday. The outlook assumes an average crude price of $55 a barrel.

The forecast is little changed from Exxon’s outlook a year ago. At the time, Brent crude, the benchmark for international oil sales, traded for about $108 a barrel. The price has since fallen about 44 percent as global supplies grew faster than consumption, an imbalance Exxon Chairman and Chief Executive Officer Rex Tillerson suggested may not change any time soon.

“There’s a lot of supply out there and I don’t see a particularly healthy economy,” Tillerson said during the presentation at the New York Stock Exchange.

Crude output from U.S. shale fields probably won’t decline much, if at all, in response to tumbling oil prices, said Tillerson, who entered his 10th year as CEO in January. Politically volatile regions such as Libya and Iraq will add to the global glut as conditions improve, putting additional pressure on prices, he said.

Even in the current price environment, Exxon said it can continue to earn “attractive returns” with its onshore U.S. production.

Production growth will be driven by oil and so-called gas liquids such as propane, which will increase by 7 percent this year and 4 percent annually in 2016 and 2017, according to the presentation. Natural gas output will drop 2 percent annually this year and next before rising 4 percent in 2017, the Irving, Texas-based company said.

Exxon fell 0.5 percent to close at $87.18 in New York. The shares are down 9.7 percent in the past year.

5 biggest geopolitical risks of 2015

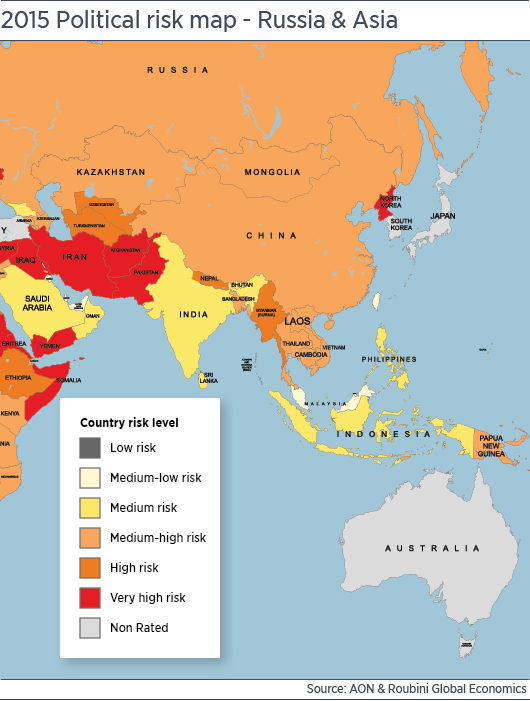

The map shows levels of geopolitical risk in developing nations. Yellow indicates medium risk, orange high, and red very high risk. Developed nations are not rated.

Critical events of early 2015 — cheap oil and Middle East violence — will probably continue to take their toll as the year goes on, according to a new projection of geopolitical hotspots. Lower overall prices for commodities may hurt the economies of resource-rich nations.

Aon Risk Solutions, a unit of Aon Plc, today issued its annual Political Risk Map, intended to provide the British insurer's clients with answers to common questions about where it’s getting safer, and more dangerous, to do business.

There isn't a lot of good news. Just seven of 163 developing countries reduced their political risk since last year, and most of those, like Zimbabwe and Laos, still have plenty of room for improvement. Twelve countries face greater strain this year, including Libya, Haiti, and Pakistan.

“The last 12 months have just been catastrophic country-risk-wise,” said Curtis Ingram, vice president of the political-risk practice. It’s almost like “a vacuum has opened up and a lot of bad actors have moved in,” in Crimea and Eastern Ukraine, Nigeria, Iraq, and elsewhere.

Aon and research partner Roubini Global Economics, founded by the economist Nouriel Roubini, evaluate each nation across nine categories of risk, such as foreign currency exchange and capital conditions, law and regulation, and political interference and violence. The report considers only developing nations; members of the Organization for Economic Co-Operation and Development (OECD) together form the baseline for the research and are therefore excluded.

Here are five of the things the report says we should keep an eye on in the months ahead.

Russia

Low oil prices and international sanctions stemming from the Ukraine conflict have taken their toll on the Russian economy. The murder last week of Boris Nemtsov, an opposition leader and Yeltsin-era deputy prime minister — not mentioned in the report but a dark omen — has exacerbated internal political tensions.

Russia’s instability will “continue to cast a shadow over the region,” according to the political risk report, which projects consequent hardships for trading partners Belarus and Kazakhstan. Researchers see “a possible frozen conflict and continued sanctions” in Ukraine, unlikely to be resolved in the months ahead.

Oil and other commodities

Russia, Venezuela and Iran have drawn much of the attention, and punishment, from the oil glut. It’s also a problem for smaller powers, such as Uzbekistan and Turkmenistan, whose fragile foreign currency exchange and capital policies leave them vulnerable to trade shocks. Mining- and energy-heavy nations in Africa — Angola, Cameroon, Congo, and Nigeria — all face weaker incomes and likely spending cuts.

Conflict and violence

The horrors of Islamic State in Syria and Iraq, and Boko Haram in Nigeria, are top threats to regional stability. Porous borders and immature civic institutions in parts of the Middle East and Africa make nations there particularly sensitive to violence.

Interest rates

Even odest interest-rate increases by the Fed will intensify the global competition for capital and make it costlier to service external debt.

The Middle East and North Africa

Countries such as Egypt, Tunisia, and Morocco should see a boost from the oil price drop, the report's authors suggest. Yet all three countries, rated either high or very high risks, face countervailing security risks from what the report calls power vacuums in Iraq, Libya and Syria.

There's also everywhere else. Private insurers have offered political risk coverage for several decades, to help companies take some of the edge off doing business in new and emerging markets. But, like most of us, the problems of these places like to travel. Turkey and Mexico, for example, may be particularly politically or economically vulnerable to tumult in the Middle East and Latin America. But as OECD members, they pose risks that aren’t addressed in the report.

In other words, pessimists shouldn’t feel confined to the developing world.

Talks to End Strike by U.S. Oil Workers Set to Resume Next Week

(Bloomberg) -- Royal Dutch Shell Plc and the United Steelworkers’ union will resume talks Monday on a new labor contract after ending discussions today without a resolution to the largest oil worker strike since 1980.

The two sides will meet in Houston, the union said in a statement. The discussions come amid a walkout that’s widened to 12 refineries accounting for almost 20 percent of the capacity in the U.S. Shell is leading the negotiations with the 30,000-strong United Steelworkers on behalf of companies including Exxon Mobil Corp. and Chevron Corp.

The union is trying to limit the use of contractors for routine maintenance and tighten overtime rules in the new pact, which will be good for the next three years.

The walkout of U.S. oil workers is the first national action since 1980, when a stoppage lasted three months. In all, the USW represents workers at sites that together account for 64 percent of U.S. fuel output.

Rejected Offers

The USW last expanded the strike on Feb. 20 to include a Shell chemical plant in Norco, Louisiana, and Motiva Enterprises LLC’s Port Arthur, Texas, refinery, the nation’s largest, along with its refineries in Norco and Convent, Louisiana. Motiva is a joint venture between Shell and Saudi Arabian Oil Co.

Workers were already on strike at Shell’s Deer Park complex in Texas; Tesoro Corp.’s plants in Martinez and Carson, California, and Anacortes, Washington; Marathon Petroleum Corp.’s Catlettsburg complex in Kentucky and Galveston Bay site in Texas; LyondellBasell Industries NV’s Houston plant; and BP Plc’s Whiting, Indiana, and Toledo, Ohio, refineries. A Shell chemical plant in Deer Park and a Marathon co-generation plant in Galveston Bay are also included in the strike.

The union, which has rejected seven contract offers from Shell, says USW members should handle daily maintenance at plants. Shell has said the union’s demands would take away hiring flexibility.

About 6,550 people have joined the strike, USW statements show.

Iraq Bond Investors Keeping Eyes on Barrels Per Day: Arab Credit

(Bloomberg) -- As Iraq’s troops battle Islamic State to retake Tikrit and the government grapples with a squeeze on revenue, a surge in oil production is helping the nation’s bonds stage their best rally since December.

Output increased to a record 3.7 million barrels a day in December, as OPEC’s second-biggest producer seeks to offset the effect of a nine-month slump in crude prices. The yield on the nation’s bonds due in January 2028 fell for the past seven days, the longest streak for more than two months, data compiled by Bloomberg show. It was trading at 7.62 percent on Wednesday.

The war against the al-Qaeda breakaway group since June has battered Iraq’s non-oil economy and, along with the slump in crude prices, will widen the budget deficit this year, according to the International Monetary Fund. Jabbar al-Abadi, a member of parliament’s finance committee, said in an interview this week that the government is struggling to find the money to pay salaries and rebuild homes destroyed in the fighting.

“The arrival of ISIS caused a big drop in the price but the bond slowly recovered,” Anthony Simond, London-based analyst for emerging-market debt at Aberdeen Asset Management Plc, said by e-mail March 3. The surge in oil production “shows that ISIS hasn’t had a major effect” on the industry, he said.

Hydrocarbon Industries

Oil exports are Iraq’s biggest source of revenue. Gross domestic product from hydrocarbon industries will probably expand 5.7 percent this year, the second-fastest pace among Middle East producers, the IMF estimates show. Production was about 3.5 million barrels a day in February.

The cost of insuring Iraq’s dollar-denominated debt against default tumbled 41 basis points, or 0.41 percentage point, in the last two weeks to 334, according to data compiled by Bloomberg. That compares with 374 basis points for Lebanon, an oil importer whose economy has been hurt by the civil war in neighboring Syria.

The gains come as Iraq’s budget is hit by the war and oil-price slump. The IMF expects the deficit to widen to 6.1 percent of gross domestic product from 4.9 percent in 2014. Gross external debt is expected to increase to 58 percent of GDP from 48 percent last year, according to HSBC Holdings Plc estimates.

‘Significant Blow’

“They need an oil price of above $100 a barrel to balance their budget,” Razan Nasser, a senior Middle East economist at HSBC in Dubai, said by phone Tuesday. “The issue is that on the expenditure side they’re quite limited in the extent to which they can cut spending given their security issues, their reconstruction and rebuilding needs.”

Brent crude traded at about $60 a barrel on Wednesday, and has risen 4 percent this year, paring a slide of almost 50 percent in the second half of 2014.

The government owes international oil companies $9 billion for 2014, Oil Minister Adel Abdul Mahdi said March 2. The government “is definitely heading to borrow money,” said Abadi, the lawmaker. The central bank said on Jan. 27 it plans to re-purchase Treasury bills from the secondary market and will help finance the budget deficit.

Iraqi bonds are still attractive to investors, in part because Islamic State’s advance has been halted, said Raza Agha, chief Middle East and Africa economist at VTB Capital Plc.

The bonds also offer better yields than other junk-rated oil producers in the region, he said by e-mail Wednesday. Nigeria’s bonds due 2023 yield about 6.65 percent.

“If you are going to have any exposure to an oil credit via traded external debt, why not earn the yield as well?” Agha said.

Crude Production Reaching Storage Limit

EconomyWatch EconomyWatch News Desk Team

Producers prepare for drastically low oil and gasoline prices in the coming months as stockpiles increase. The United States has been producing a million more barrels a day than it is consuming in the last seven weeks.

The U.S. Department of Energy reported American supplies are at its highest capacity in 80 years. Crude inventories have been reaching overcapacity in storage tanks, otherwise known as "tank tops." Companies are reducing drilling in the short-term, but excess supplies do not expect to decline until later in the year.

How Low Prices Could Go

Ed Morse from the Council on Foreign Relations and other forecasters believe oil prices could fall as low as $20 a barrel. But there is some good news for the energy industry. Unknown factors such as power outages and low refinery output could prevent a sudden decrease in energy prices. Rising demand would also help ease additional inventory, and storage construction is underway to hold future stockpiles. American producers have already been struggling from Saudi Arabia's flooding of the market with cheap crude, and an added glut on the domestic front could place the American energy sector at a virtual standstill.

Shale Industry in Peril